Fundamental Forecast for Japanese Yen: Neutral

– Retail traders have recently embraced Japanese Yen weakness, suggesting a bottom may be nearing.

– The strong November US NFP report didn’t just lift USDJPY – it boosted risk-appetite more broadly.

– The Japanese Yen may be primed to continue its depreciation against the British Pound.

The Japanese Yen continued its stretch of broad underperformance in the first week of December, dropping by a noteworthy -2.42% against the top performer, the New Zealand Dollar, as risk appetite trends remained resilient despite mixed signals from both central banks and economic data. With Japanese data more or less steadying at this point – the Citi Economic Surprise Index is at 5.70, slightly lower than the rolling 20-day average (four weeks) of 8.18 – the driving forces on the Yen have been largely exogenous in nature.

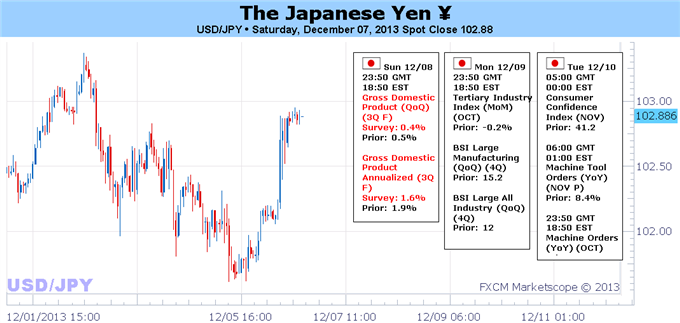

Indeed, the Yen saw quite a rollercoaster this week. The USDJPY opened the week at ¥102.45, rose to a high of 103.38 by Tuesday, crashed to 101.63 by Thursday, and finally settled at 102.91 by the close on Friday. It was not just against the US Dollar this was the case; the Yen was broadly stronger through Thursday as equity markets pulled back from recent elevated highs.

The reasons for the diminished risk appetite midweek may be predicated around the notion that additional central bank action, at least from the major ones, is unlikely in the near-term; the European Central Bank help policy after cutting its main rate to a record low of 0.25% in November, bucking critics’ calls for another LTRO amid weak excess capital levels at Euro-Zone financial institutions.

Friday’s US Nonfarm Payrolls report was an entirely different animal. True, the headline +203K figure bested the expectation at +185K, and the Unemployment Rate fell to 7.0%, the lowest rate in five years. Yet markets remained unimpressed. Any sign that the Federal Reserve might taper QE3 – rising US bond yields – evaporated by the end of the day. Nevertheless, the USDJPY settled at its daily while other USD-pairs – notably AUDUSD and EURUSD – did as well. This seems controversial (USD weakness was not consistent).

Perhaps market participants are becoming better trained to the Fed’s forward guidance. While this marked the second consecutive NFP above +200K, the three month average fell to +192.7K from +204.3K. The 12-month average fell to +191.1K from +194.75K. In a sense, then, the US labor market saw momentum slip a bit; a positive reading, but not as good as it appears on the surface.

These conditions – the Fed’s promise of keeping interest rates pointed lower amid a steady stream of improving (but not rapidly) economic data is supportive for risk appetite. By the end of the week, the rotation wasn’t necessarily out of the US Dollar; but rather out of low yielding currencies into growth-positive, higher yielding currencies. The Yen’s lack of yield relative to the US Dollar is why it declined; that is why both the Dollar and the Yen slipped elsewhere on Friday. Tapering is not tightening.

This week, depending which theme markets decide to entertain – no more easing from major central banks (end of FLS, no more LTRO, and tapering QE) or the persistence of low interest rates (the BoE’s, the ECB’s, and the Fed’s forward guidance) – the Yen stands to move sharply in either direction. Japanese rebound is largely mixed this week with 3Q’13 GDP forecasted to be downgraded to +1.6% from +1.9% (annualized), while a rebound in October data (Tertiary Industry Index and Machine Tool Orders) is expected.

A selloff in US equity markets (theme: no more stimulus) would aid the ailing Yen, especially if the concern stretches into Japanese bond markets. The JGB 10Y yield closed at 0.669% this week, its highest since October 15, after touching 0.685%, its highest since October 1. Rising JGB yields from mid-May to early-June contributed to the Yen’s dramatic rise and fall midyear. Rising yields and speculation that any speculation anew that additional Bank of Japan easing is a distant possibility would be the ideal accelerant for a rebound. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx