The New Zealand dollar was in focus overnight on Thursday, soaring to a one-year high after the Reserve Bank of New Zealand kept interest rates unchanged, surprising market participants that were betting on a rate cut.

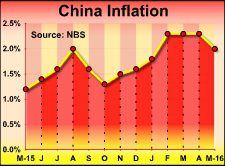

The kiwi jumped 1.7 percent to 0.7148, reaching a high not seen since June 2015 after the RBNZ held rates steady but retained an easing bias. Governor Graeme Wheeler said at a media conference the central bank would not hesitate to adjust interest rates if needed. Wheeler added that inflation expectations have stabilized and that some inflation pressures were beginning to come through.

The governor's post-meeting remarks pushed the kiwi higher, with no concrete hints that policymakers would cut interest rates in the near-term.

The Dollar index bounced up to 93.67 after touching 93.515, just inches from a one-month low of 93.425 hit on Wednesday amid fading expectations the US Federal Reserve would raise interest rates as early as its meeting next week. US interest rate futures are now suggesting forex traders saw nearly no chances the Fed would hike rates this month.

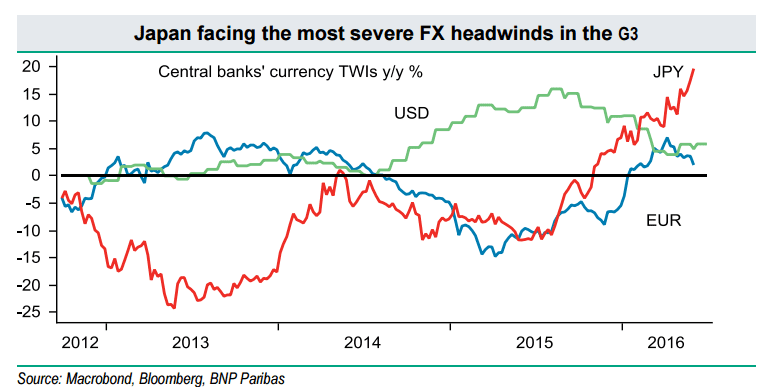

USD/JPY slipped to a fresh one-month low by 106.28 as dismal Japanese machine orders data showed signs for concern for business investment. EUR/USD retreated from a four-week peak by 1.1415 and now trades at 1.1379 following a surge in German Bund yields which notched record lows on Wednesday as the European Central Bank began buying corporate debt for its stimulus program.

Uncertainty over the outcome of Britain's June 23 referendum over whether to remain in the European Union has increased demand for safe-haven Bunds, pressuring their yields. Sterling, which has whipsawed in recent sessions on divergent surveys on the likely vote outcome, eased more than 0.30 percent to 1.4453.