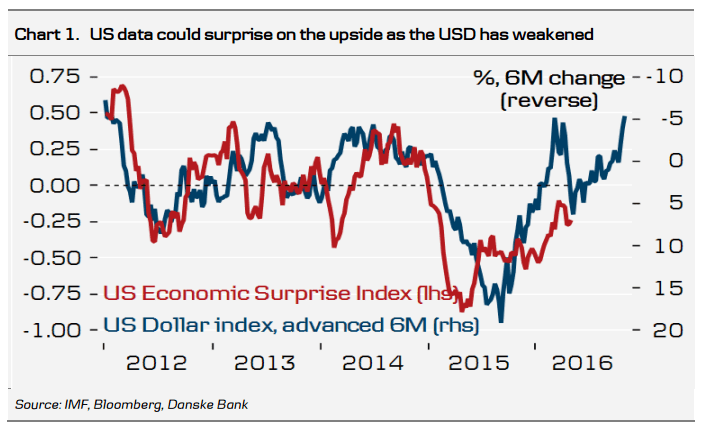

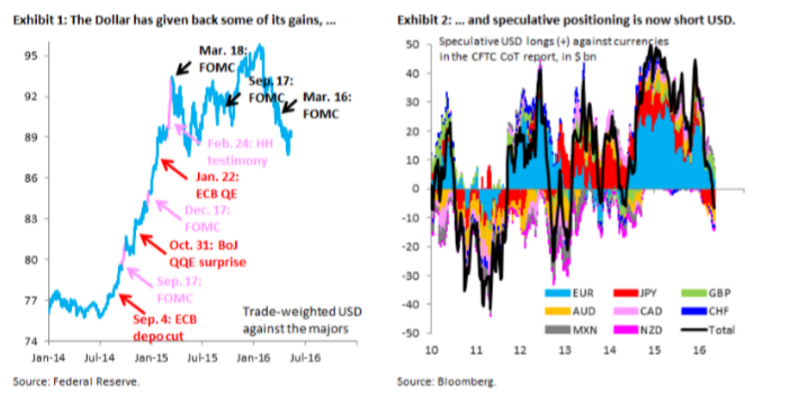

The US dollar index closed its sixth consecutive day of declines yesterday, with the index closing at 92.58. Yesterday US ISM Manufacturing for April declined and came out softer than expected at 50.8.The USD declines helped US equity close in the positive yesterday.

Overnight data showed that the Chinese Manufacturing PMI for the month of April surprised lower with actutal figures coming out at 49.4, disappointing expectations of 49.8 and a previous 49.7. Softer Chinese data however did not manage to de-rail Asian equities that mostly registered gains in today’s session.

The Reserve Bamk of Australia (RBA) decided to lower its cash rate to 1.75%, at its meeting today. The Australian Central Bank cut 25bp from the previous 2% as it hopes to head off deflationary forces.

Even the euro enjoyed the USD weakness as the EURUSD embraced 1.15 levels yesterday and is currently at 1.1531. USDJPY continued to manifest supprt for the Yen as even the USD weakened. After the BoJ disappointed expectations for further easing last week the Yen got caught in a short squeeze.

Ahead in today’s economic calendar UK PMI manufacturing is expected to rise to 51.2, we also have EZ PPIs and US ISM New York.