Yesterday the release of the minutes of the 20-21st September FOMC meeting showed that there remains a strong favour from the voting members of the commitee to raise rates soon. Despite the hawkishness between the members they have so far opted to be prudent, but this decision takes a new level as we approach November Presedintial elections.

USD strength, as could be expected, has continued as bond yields rise and as the expected rate rise seems closer than it has ever been throughout this past year. The US Dollar index (DXY) has shown some signs of consolidation as it pulls back a little this morning but has so far kept well within the sight of 98 levels.

EURUSD is approaching 25th July lows, we’re currently seeing a price of 1.1019 but 1.0950 seen last July is increasing just a few pips away.

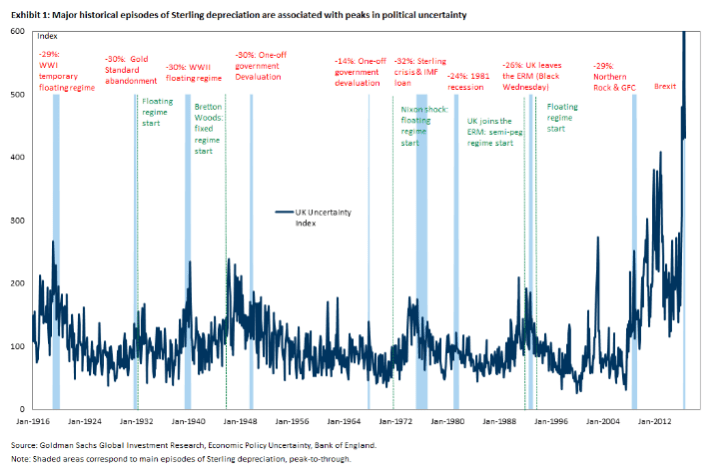

Sterling is nursing its wounds after a sharp decline pushed it to 1.1904 against the USD last Friday. We are currently seeing a price of 1.2189. The British pound has been hit hard on concern of a hard Brexit after the British PM, Theresa May, starting to give Brexit more shape.