US equities closed in the red yesterday the prospect of more soon-to-be rate hikes resurfaces on the back of the hawkish FOMC minutes published Wednesday. Asia however was able to shrug the negative trend and up to the time of writing is in positive territory.

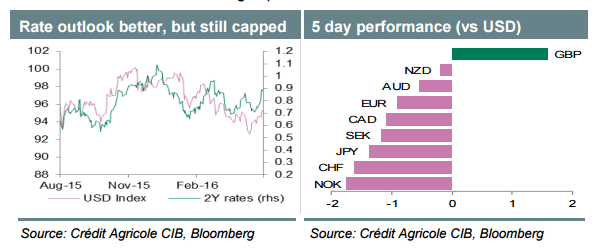

Markets are attributing a 30% chance for a June rate hike and 60% of a July rate hike and the US dollar is reflecting it as US equities sell off. The US Dollar Index (DXY) an index which measures the USD’s performamce against a basket of currencies, is up 3.90% from its month’s low of 91.91 and is currently trading at 95.31.

The USDJPY has taken on the 110 levels and has seen highs of 110.14 earlier in today’s session.

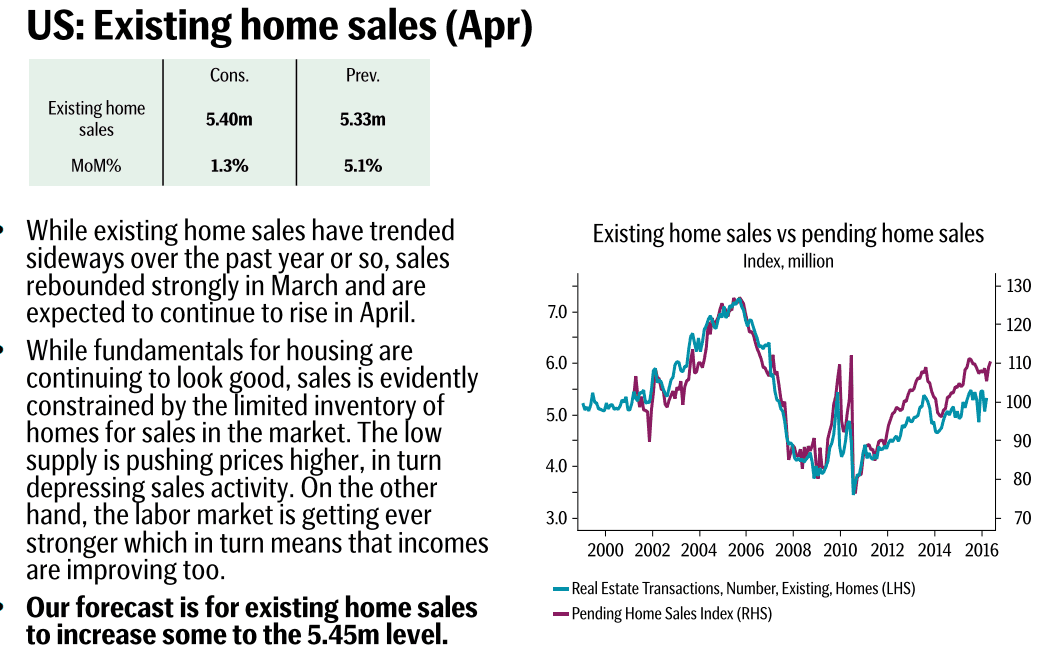

Later in today’s economic calendar we are expecting EZ current account, Canadian CPI, US Existing Home Sales.