Pound to Face Limited Correction Amid Shift in BoE Policy Outlook

Fundamental Forecast for the British Pound: Bullish

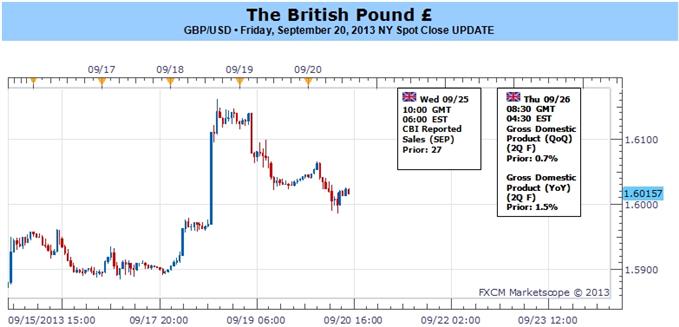

GBP/USD Rallies to Fresh Highs as BoE Votes 9-0 against More QE

GBP/USD Encounters Resistance at the “Hidden Fibo”

For Real-Time Updates and Potential Trade Setups on the British Pound, sign up for Analyst on Demand

The British Pound extended the advance from earlier this month as the Bank of England (BoE) struck a more hawkish tone for monetary policy, but the GBPUSD may face a near-term correction in the days ahead as the pair remains overbought.

Indeed, the BoE Minutes showed no votes to further embark on quantitative easing as the central bank anticipates a stronger recovery in U.K., and there’s growing speculation that the Monetary Policy Committee will implement its exit strategy ahead of schedule as the committee turns increasing upbeat towards the economy.

With BoE members Ben Broadbent, David Miles, Paul Tucker, and Charles Bean scheduled to speak next week, more comments signaling an end of the easing cycle should help to prop up the British Pound, and we may see a growing number of MPC officials show a greater willingness to switch gears in 2014 as the central bank continues to operate under its inflation-targeting framework. A further look at the economic docket shows the final 2Q GDP report printing a 0.7% rise in the growth rate, but an upward revision may further the BoE’s case to move away from its easing cycle as the economy gets on a more sustainable path.

Should the fundamental developments coming out of the U.K. continue to raise the outlook for growth and inflation, the pullback from 1.6161 may be short-lived, and the GBPUSD may ultimately carve a higher low going into the final days of September as the upward trending channel dating back to the July low (1.4812) continues to take shape. However, as the relative strength index falls back from a high of 82, a break of the bullish trend in the oscillator may foreshadow a larger pullback in the GBPUSD, and we will look for opportunities to buy dips in the British Pound amid the shift in the policy outlook. – DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx