Sentiment was positive with most of the major equity indices in the US yesterday and Asia this morning, in green territory. The rise in equity was mostly attributed to the increase in the price of Apple and new highs for the price of oil.

The price of Apple rose after news that Berkshire had upped its stake in the company during the first quarter of 2016. Oil in turn is close to 6-month highs on concerns of possible outages in supply.

The USD followed the rise in equities and US Treasury yields higher as it continued to pare the losses made in April. May has been a positive month so far for the greenback that was up at least 3% so far this month.

With oil in higher territory even the commodity bloc currencies, namely the Aussie, NZD, and the CAD were on a positive tone this morning. The AUDUSD is on its second day of gains as it takes on the 100DMA as it recovers from Monday’s lows of 0.7244.

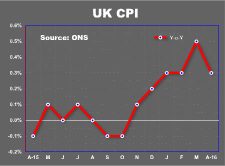

The GBP was firmer this morning ahead of UK CPI that is expected to hold its previous levels. From today’s economic docket we also have EZ trade balance, US CPI and US Housing starts amongst others.