Key Points

- New Zealand dollar surge continued vs the US Dollar, as it traded above a major resistance area.

- There was a crucial resistance around the 0.7050 levels, which was broken recently by the Kiwi dollar bulls.

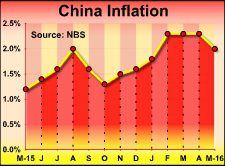

- The Chinese Consumer Price Index released by the National Bureau of Statistics of China posted a decline of 0.5% in May 2016.

- In terms of the yearly change, there was an increase of 2% in the Chinese Consumer Price Index, less than the forecast.

Technical Analysis

The New Zealand Dollar had a nice run vs the US dollar recently, as it traded higher and cleared a major resistance area near 0.7050, as highlighted in the 4-hours chart below. There was also a resistance trend line on the same chart, which was broken during the upside move.

The NZDUSD pair traded as high as 0.7137, and currently facing sellers which may ignite a minor downside correction.

On the downside, the broken resistance area along with the 23.6% Fib retracement level of the last leg from the 0.6674 low to 0.7137 high may act as a support.

Chinese Consumer Price Index

Today in China, the Consumer Price Index, which is a measure of retail price variations within a representative basket of goods and services was released by the National Bureau of Statistics of China. It. The market was expecting a decrease of 0.2% in May 2016. However, the report was negative, as there was a decline of 0.5% in the Chinese CPI.

Moreover, in terms of the yearly change, there was an increase of 2% in the Chinese Consumer Price Index, whereas the market was expecting a rise of 2.3%.

Overall, the risk sentiment may be impacted after the Chinese CPI, and may ignite a minor correction in the NZDUSD pair.