Key Points

- The New Zealand dollar recently traded higher towards the 0.7030 level against the US Dollar.

- The NZDUSD pair found sellers above 0.7000, and started moving down towards the 0.6970 support.

- Earlier during the Asian session today, the Caixin China Services PMI™ was released.

- The result was above the forecast, as there was a rise from the last reading of 53.1 to 53.4 in Dec 2016.

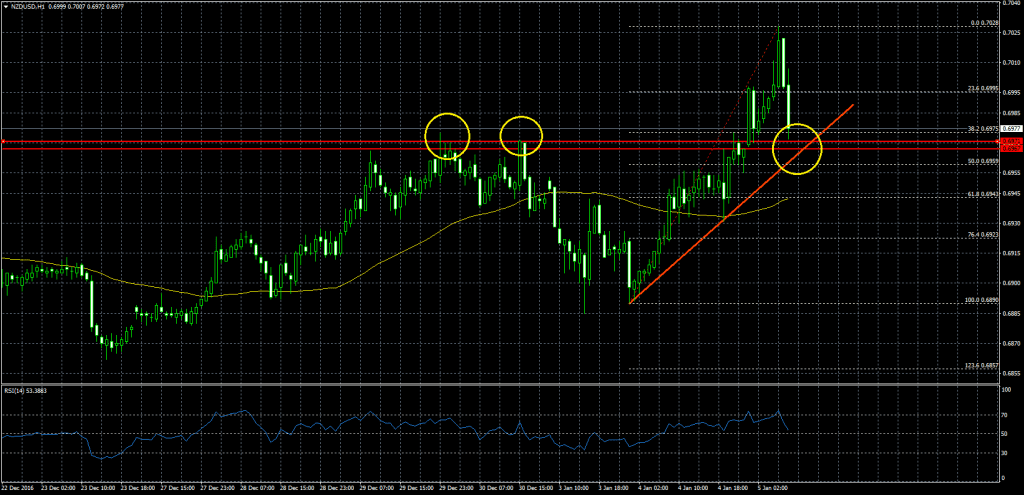

NZDUSD Technical Analysis

The New Zealand dollar started an uptrend from the 0.6890 low and traded above the 0.7000 level where it found sellers. The NZDUSD pair is currently moving lower, and about to test a major support area near 0.6970. It was a resistance earlier, and may now act as a support.

There is also a bullish trend line on the hourly chart of NZDUSD at 0.6970, and it also coincides with the 38.2% Fib retracement level of the last leg from the 0.6890 low to 0.7028 high.

On the upside, a break above the recent high of 0.7028 is needed for more gains.

Caixin China Services PMI

Today in China, the Caixin China Services PMI™, which is based on data compiled from monthly replies to questionnaires sent to purchasing executives in over 400 private service sector companies was released. The market was expecting a minor rise from the last reading of 53.1 in Dec 2016.

The result was around the forecast, as there was a rise from the last reading of 53.1 to 53.4 in Dec 2016. The report added that the “Improved rates of new order growth were also seen across both monitored sectors in December. The pace of new business expansion accelerated to its strongest since July 2014 at manufacturing companies amid reports of improving client demand”.

Overall, there are high chances of NZDUSD finding bids near 0.6970 and trading higher once again in the short term.