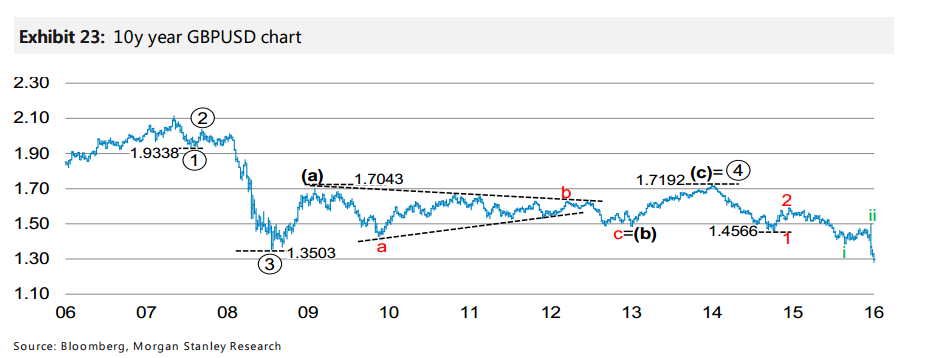

Elliot Wave–based technical analysis suggests that there is further downside for GBPUSD. GBPUSD started a 5- wave structure from its 2.1072 peak in November 2007 and is currently in the 5 wave.

Downside momentum appears particularly as this 5 wave is currently within a sub iii wave(green) within a 3 wave(red). Assuming we are correct with the 1 wave completing at the 1.9338 low in January 2008, then the 5 wave should complete near 1.24, a multiple of the length of the 1 wave.

With GBPUSD breaking multi-decade lows, we have extended our chart to highlight potential key levels from the 1980s. These are 1.1880 from May 1985 and then the 1.0545 low from 25 February 1985.

There is an area of consolidation around 1.2500, so we could expect some support here. 1.25 is also the bottom end of the range for our year-end target and the Elliot Wave–derived target as described above.

We examined EURGBP last week and still expect resistance around the 0.88 level, which was the 2013 high and close to the 61.8% retracement level of the downtrend since 2009.

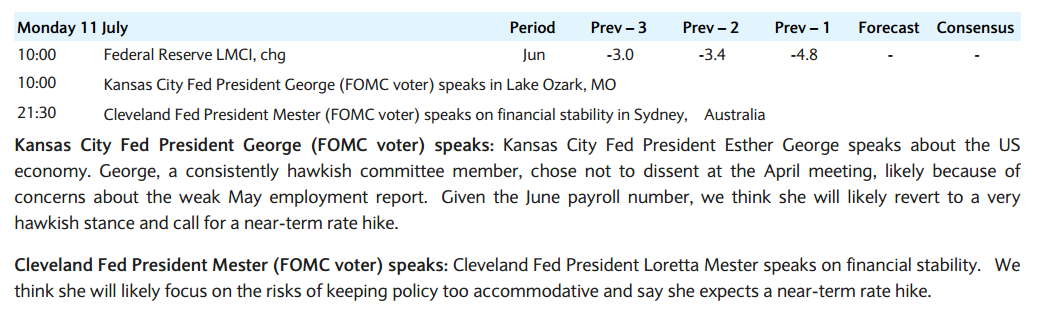

Copyright © 2016 Morgan Stanley, eFXnewsOriginal Article