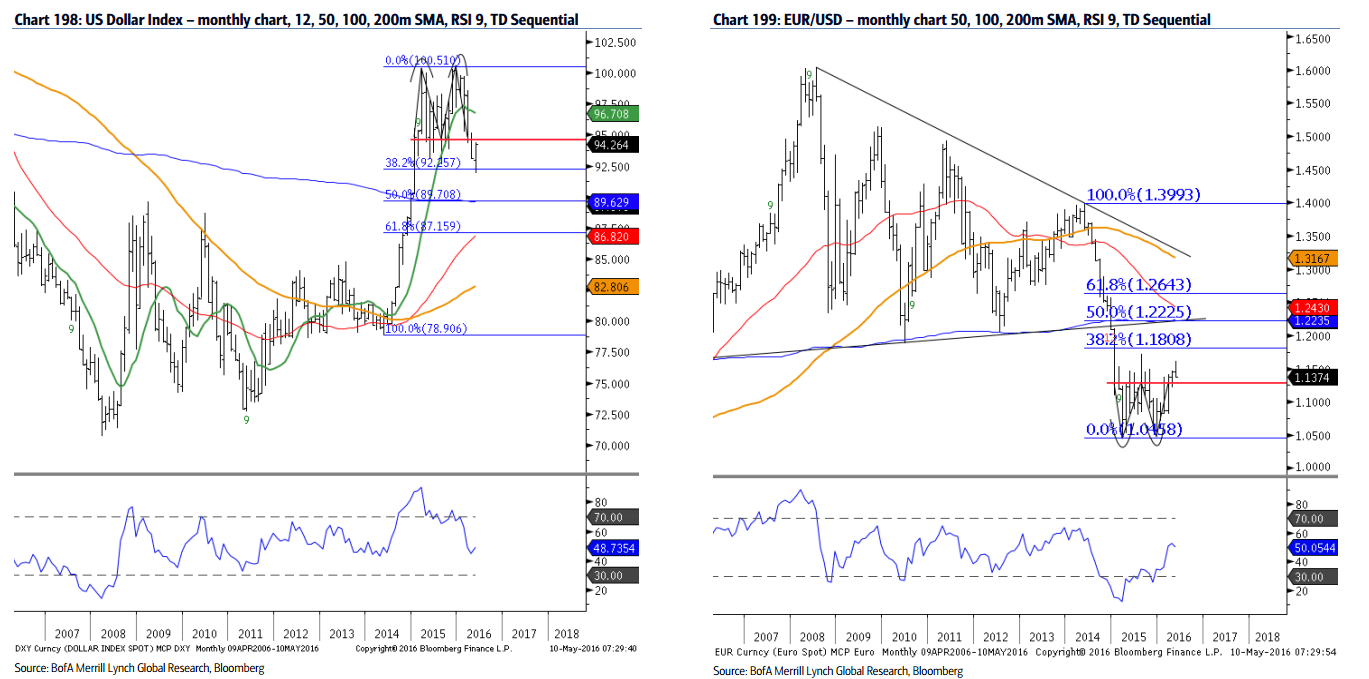

Monthly charts are bearish DXY bullish EUR/USD. The price action of the EUR/USD and DXY has been in a wide range bound trend for over a year. Ending March and reported in our Technical Advantage report, the EUR/USD made a 15 month closing high and formed a double bottom. Similarly, the DXY made a 15 month closing low and formed a double top. Considering momentum as defined by RSI, both trends showed divergences suggesting a reversal.

Our technical view suggests selling USD strength and buying EUR weakness. The DXY could decline to the 200m average and 50% retracement at 89.70 and EUR/USD could rally to 1.808 and possibly 1.22 this year.

For latest trades & forecasts from major banks, sign-up to eFXplus

Cautiously bearish USD/JPY. The downtrend in USD/JPY is becoming overextended and risks for a rally are increasing. RSI has been oversold for most of the year. MACD has not been this deep in well over five years. Heikin-ashi candles have been bearish for 21 of the last 22 weeks. This week is flirting with turning bullish (green – will need to be confirmed EOW).

Key support from the 200wk SMA and 2013 high at 105.25 held in the last decline. Further downside remains a possibility including the fair value area 100.70-102.50, however the trend may be in its last leg before a larger rally. We see resistance at 110.10, 111.50 and 114.

For latest trades & forecasts from major banks, sign-up to eFXplus

Copyright © 2016 BofAML, eFXnews™Original Article