Major US equity indices closed mixed, and Asia was mostly negative this morning as we await US nonfarm payroll for June this afternoon. Consensus figures are pointing towards an increase of 180k jons throughout the previous month, hopefully shrugging off May’s dismal 38k increase.

This economic data takes the limelight as the Fed awaits strong data signals before engaging in more rate hikes, and at a time were global markets are still trying to digest Brexit.

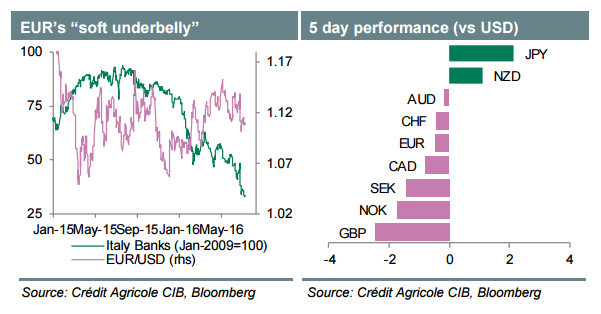

As could be expected the USD held tight, within sight of the 3 ½ month highs seen towards the end of June. The US Dollar index (DXY) is currently trading at 96.07, the highs seen in June were 96.71.

Gold has paired back slightly after having hit highs of $1375 last Wednesday, levels which had last been touched in March 2014. Gains for gold remained very well contained ahead of the ourcome of the June NFP figures due this afternoon, and is currently trading at $1358.

The languishing GBP made a small comeback, or at least managed to stay off Wednesday’s lows of 1.2789 against the USD, the GBPUSD is trading at 1.2947 at the time of writing. GBP was also bouncing off against the euro, once again gains for the battered GBP were minimal, but managed to distance itself from Wednesday’s EURGBP highs of 0.8626 as we currently trading the price of 0.8557.

It now all boils down US jobs data out at 1430hrs CET.