Gridlock = Goldilocks

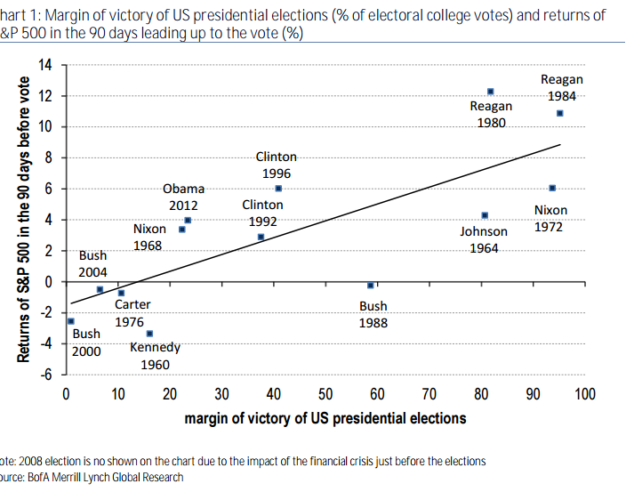

Our analysis suggests the market is pricing an easy victory for Hillary Clinton but a split Congress in the November elections. In other words, the market is pricing a high probability of continued gridlock in Washington. We believe this is the reason why the market is long risk parity trades and short volatility right now.

Risk-off ahead of November 8

Risk parity portfolios have not done well when uncertainty and volatility go up. History tells us to expect Clinton’s lead to narrow and volatility to rise in the final stretch of the elections. We recommend buying a 3-month AUD/USD digital put to position for a possible unwinding of risk parity trades that can become self-fulfilling once it starts.

Clean sweep = fiscal stimulus = stronger USD and higher rates

We cannot remember the last time the FX and the rates markets have so much at stake in a US election. While gridlock probably means lower rates and a weaker USD, a clean sweep would likely lead to both higher USD and higher rates over the medium-term, in our view. We believe the volatility market is underpricing the bi-modal nature of the outcome of the election for US fiscal policy outlook.

Copyright © 2016 BofAML, eFXnews™Original Article