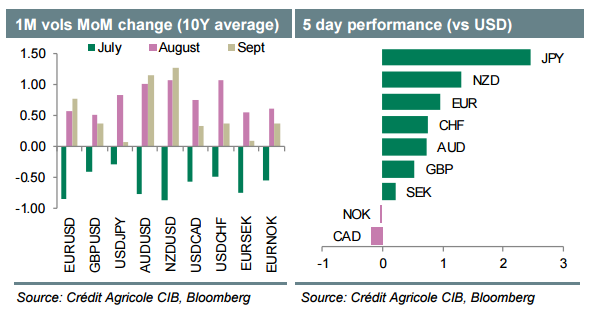

Policy changes out of the BoJ have failed to impress this morning and we have seen support for the JPY rally in today’s session. USDJPY has slipped to the current 103.13 from the previous 50-day moving average around 105.50 that we had seen earlier in the session.

The expected stimulus from the Bank of Japan was seen as fairly modest, with raises in purchases of ETFs (rising at an annual pace of 6 trillion Yen as opposed to a previous 3.3 trillion Yen) but with much of the current 80 trillion Yen program otherwise remaining the same.

Aside from the volatility brought about by the BoJ event it looks like the mood was predominantly negative for major equity indices in Asia, with the largest losses manifested in the Japanese Nikkei.

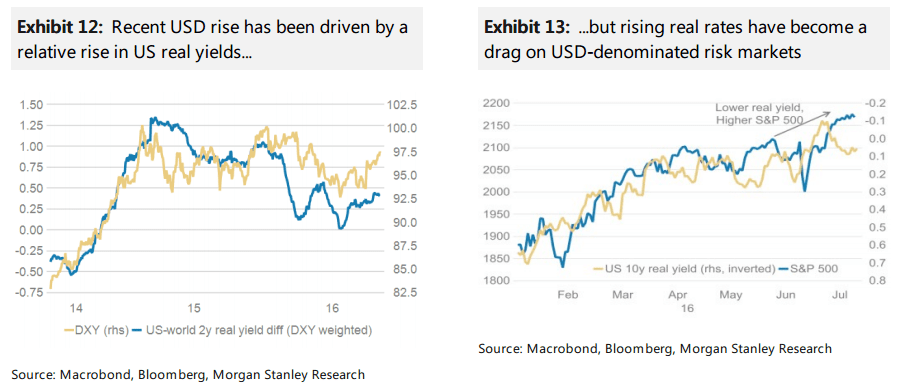

Yesterday German CPI index came a tad higher at 0.4% compared to the previous 0.3%, this morning the Euro continues to take advanatge of a softer US Dollar, as the US dollar index (DXY) enters its 5th consecutive day of losses.

The economic docket now shifts to europe for EZ GDP figures and later to Canada for another GDP reading. The US will also report its annualized GDP reading and latest personal consumption numbers.