USDJPY is close to re-testing yesterday’s lows of 111.47 and is currently trading at 111.54. The Yen enters its 3rd consecutive day of gains so far and is marking gains across the major counterparts this morning. The Yen is perceived as a safe haven currency that attracts bids in times of tension.

In the meantime war of words between North Korea and the US continues as on Monday North Korea’s foreign minister said that the US had declared war and went on to say that they were ready to shoot down US bombers, even if not directly in their airspace.

The US Dollar is taking a step-back this morning with the US Dollar index (DXY) currently trading at the price of 92.58, after yesterday’s positive close. Throughout yesterday’s session the DXY found support at the 20DMA just off 92.20.

The euro faced selling pressure after the ECB’s words of caution with regards to volatility, and that ample accomodation was still required to make sure no shocks are delivered to the system. EURUSD is currently trading at 1.1856 after slipping lower throughout Monday’s session.

The single currency was also pressured by the outcome of last weekend’s general elections in Germany. The German Chancellor Angela Merkel won its fourth term in office but concerns rather clouded the win as her coalition looks more frail, with support shifting to the far right.

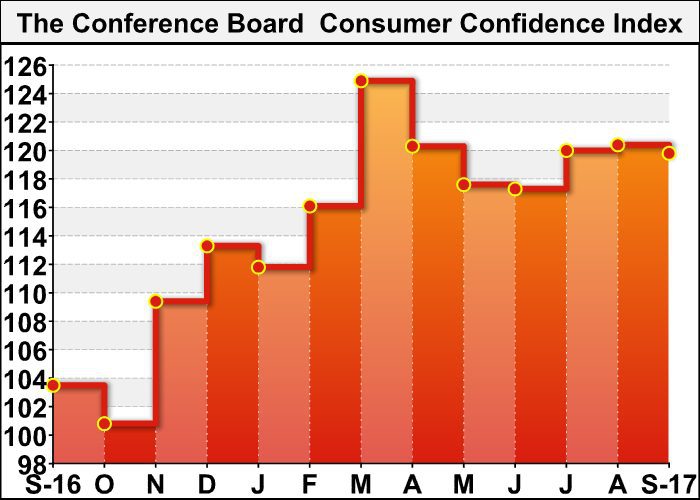

Today’s highest impact event on the economic schedule are mostly due in the afternoon during the US session. We are expecting the latest data for US Consumer Confidence for September and later Yellen is expected to speak on inflation and monetary policy.