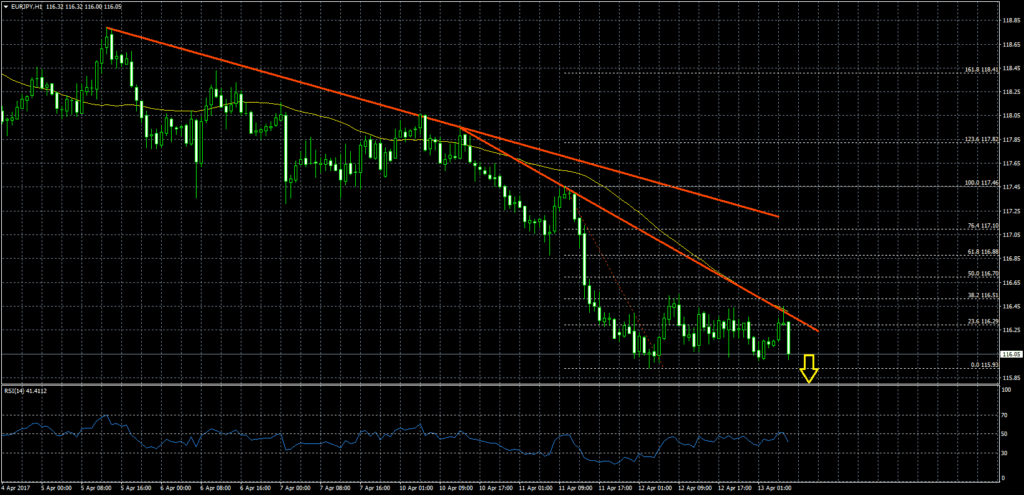

ANB AMRO FX Strategy Research notes that the recent deterioration in investor sentiment has resulted in a strengthening of the yen across the board.

In that regard, ANB AMRO argues that the the current developments in the options market suggest that investors have started to hedge the possibility of an unfavorable outcome in the second round of the Presidential elections which has resulted in higher demand for the yen versus the euro.

What's Next?

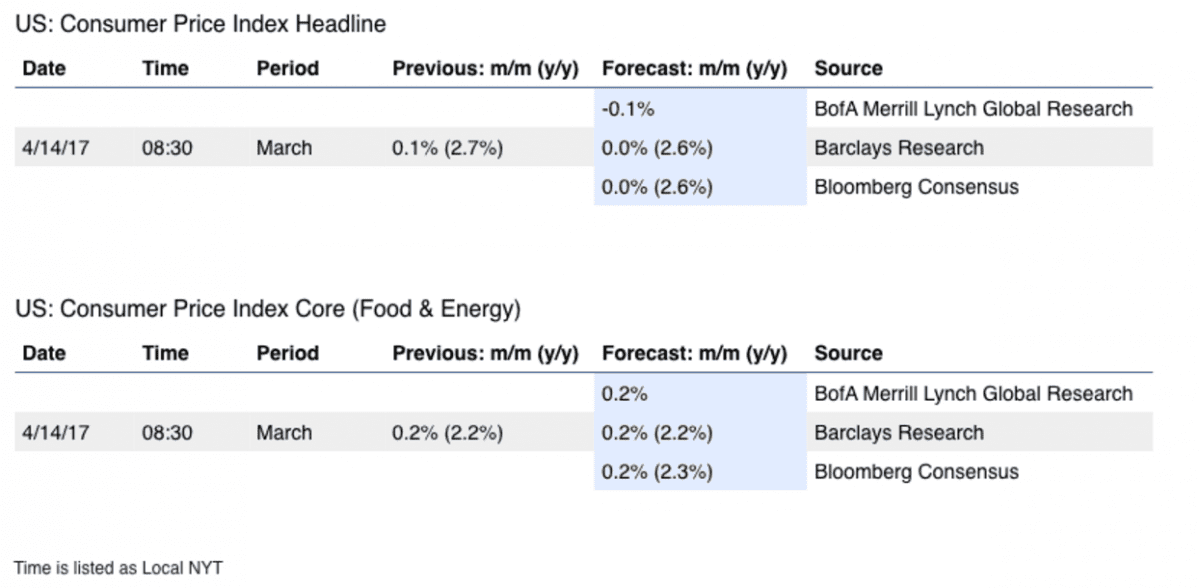

ABN AMRO argues that 1- if the outcome of the French Presidential elections were to result in a sharp deterioration of investor sentiment, USD/JPY could drop to 100 in the near term.

However, ABN AMRO believes that 2– upon a favorable outcome of the French elections, investor sentiment will recover and the yen will likely fall again.

"Furthermore, the BoJ will likely try to avoid a sharp strengthening of the yen. Overall, we do not expect yen strength to be sustained," ABN AMRO argues.

USD/JPY is trading circa 109 as of writing.

Source: ABN AMRO ResearchOriginal Article