Data in this report cover up to Tuesday August 9 & were released Friday August 12.

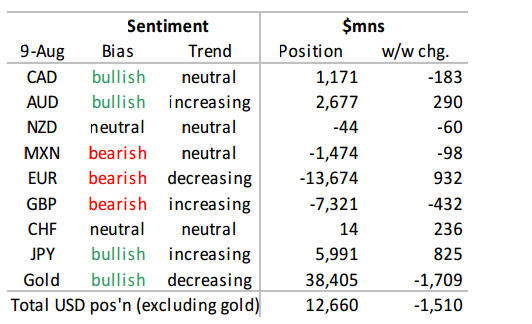

This week’s changes in sentiment were relatively limited as investors added to record shorts in GBP while paring risk in EUR.Changes for AUD and CAD were minimal, and JPY remains the largest held net long. Bears remain the dominant force in driving sentiment for CAD, EUR and GBP. Bulls have been primarily responsible for changes in sentiment for AUD and JPY.

EUR bears remain dominant, driving much of the action in sentiment with a second consecutive week of short covering. The net short EUR position has narrowed $1.0bn to $13.7 with a cumulative $1.8bn bump from late July. EUR bears outnumber bulls 2:1.

Bears are also driving the action for GBP, pushing short positions to a fresh record with a sixth consecutive weekly build. The net short GBP position is sizeable at $7.3bn, and the balance is impressively skewed with GBP bears outnumbering bulls 3.5:1.

JPY remains the largest held net long and its second consecutive week of improving sentiment is pushing it back to the upper end of its one year range. Bulls remain the dominant force in the current environment, as JPY bulls outnumbering bears 2.3:1.

CAD sentiment has deteriorated for a second consecutive week following a five week run of improvement from early July. The $1.2bn net long position is relatively modest at the upper end of its one year range and we highlight the risk of a broader medium-term swing posing downside risk to CAD.

Copyright © 2016 Scotiabank, eFXnews™Original Article