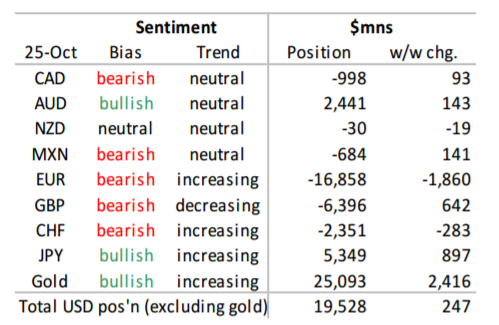

Data in this report cover up to Tuesday Oct 25 & were released Friday Oct 28.

The aggregate long USD position is up a modest $0.3bn w/w, rising to $19.5bn at levels last seen since early February. The USD position is primarily composed of net short EUR, GBP, CHF, and CAD positions, offset by net long JPY and AUD positions. This week’s details show a steady, aggressive build in EUR risk to both sides and renewed confidence among GBP bears following the flash crash. Bullish JPY sentiment has risen modestly however the broader YTD trend is suggestive of a turn.

EUR sentiment has deteriorated for a fourth consecutive week, the net short widening $1.9bn to $16.9bn with an impressive build in risk to both sides. The gross long EUR position has climbed to a fresh multi-year high around 143K contracts, nearing the record 147K from 2007, and gross short positioning is equally extended approaching 267K contracts just shy of the 271K record from March 2015. EUR appears extremely vulnerable.

Investors have added to GBP risk on both sides, narrowing the net short position for a third consecutive week. The net short remains relatively extended at $6.4bn just shy of the recent $7.8bn record. GBP bears are showing signs of renewed confidence with their first build in gross shorts since the flash crash from early October.

CAD’s net short position is relatively unchanged, narrowing $0.1bn w/w to $1.0bn. Details show a modest build in risk to both sides, reversing the adjustment that had been observed through most of October. The broader trend appears bearish.

Copyright © 2016 CIBC, eFXnews™Original Article