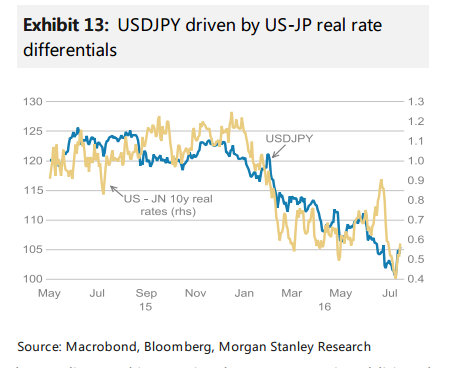

Helicopters and the JPY. The prospect of Japan adding fiscal and monetary stimulus has added to global risk appetite and pushed the JPY lower. Abe advisor Honda suggesting this morning that he discussed the idea of Japan perpetual bonds with Bernanke in April sent USDJPY rallying toward 106 on the expectation that the central bank balance sheet may be expanded at a faster rate.

Our economists feel that Japan is going to stick to a strategy of a large supplementary budget of over JPY10trn funded by additional JGB issuance in the open markets. FX markets will remain responsive to any headlines discussing ‘helicopter money’, but there is very little specific yet about what Japan’s authorities intend to do.

Authorities not yet bold enough. Should Japan’s monetary and fiscal authorities not enlarge their current tool box and add instruments able to boost Japan’s inflation expectations, the JPY will remain strong. Breaking the circuit of more government spending crowding out private investment with the anticipation of higher future tax burdens working as the catalyst will be important in reviving the economy.The BoJ providing a clear commitment to writing down some of its claims against the sovereign could do thetrick. However, such a signal would end defacto BoJ independence, suggesting the MoF becoming an inflation-targeting institution.This week the government authorities' quick denial of a newspaper article suggesting Japan was aiming for helicopter money suggests that the authorities are not yet ready to think as boldly as they did in 2013,an additional factor in our economists'view. Indeed current economic costs may not yet be high enough to make Japan consider helicopter money as an option.

Trade Strategy: Waiting for the outcome. Nonetheless, markets may need to wait for the BoJ meeting on 29 July and the outcome of the Abe administration’s supplementary budget before trading long JPY positions again.

We have closed our short USDJPY position for now and will reassess oncethere is more clarification about fiscal measures and the BoJ policy meeting has been held at the end of the month.

*Morgan Stanley hit profit stop on July 12 on its long USD/JPY from 106 around 103.60. See below for the trade history as recorded, tracked and updated by eFXplus.

(Source: Morgan Stanley Global FX Strategy, eFXplus)

Copyright © 2016 Morgan Stanley, eFXnewsOriginal Article