Gold Sheds Nearly 3% on Fed Taper- Bearish Tone Set for 2014 Open

Fundamental Forecast for Gold: Bullish

2014 Scalps Target USD Post Taper- EUR, CHF, CAD & Gold Setups

Gold Positioning Warns of Reversal as Key FOMC Announcement Looms

Sign up for DailyFX on Demand For Real-Time Gold Updates/Analysis Throughout the Week

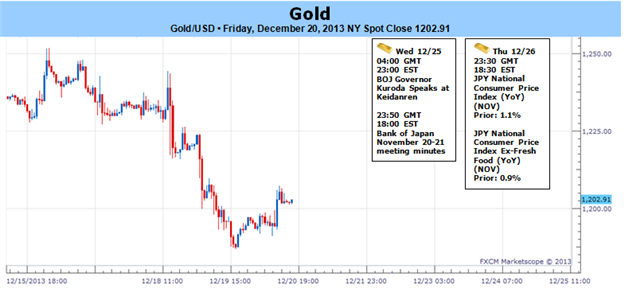

Gold was off sharply on the week with the precious metal plummeting more than 2.8% to trade at $1203 ahead of the New York close on Friday. Despite the magnitude of the weekly loss, bullion is set to close well off the lows of the week at 1187. Regardless, the metal is now set to post its first yearly decline in thirteen years and its largest yearly decline in 32 years. As the Fed begins to throttle down from its ultra-accommodative monetary policy stance, the outlook remains heavy heading into 2014.

The main event this week was the FOMC policy decision where in his last quarterly press conference as Federal Reserve Chairman, Bernanke announced that the central bank would begin tapering both Treasury & MBS purchases by $5 billion, effectively reducing QE installments by $10 billion a month. The news proved supportive for the greenback sending gold below support at $1209, its lowest level in over six months. Mr. Bernanke emphasized that tapering is not tightening and although the central bank will be reducing the amount of stimulus being injected in the economy, interest rates are likely to remain at exceptionally low levels as long unemployment remained above 6-1/2% and inflation below the 2% longer-run goal. Despite these “thresholds” the chairman continued to reassert that the move to tighten will be “data dependent” with the quarterly projections showing the majority of the committee expecting the first rate hike in 2015.

As the labor market continues to improve, more emphasis is likely to be put on inflation prospects as we head into next year with concerns over disinflation likely to support the Fed’s accommodative stance. With CPI data this week coming in below consensus, expectations for a prolonged ZIRP (zero interest rate policy) from the central bank may continue to be supportive for risk assets while the subdued inflation outlook remains heavy on bullion.

The release dealt a final blow to gold heading in to the close of the year as demand for the yellow metal continued to wane to the benefit of the greenback. As we head into next year, gold remains at risk amid an improving US economic backdrop and reduced Fed stimulus. With the threat of the fiscal drag also now subsiding, it’s difficult to see gold catching a bid as both equities and the USD press higher.

From a technical standpoint gold has continued to trade within the confines of a well-defined descending channel formation dating back to the August highs. Key support rests at $1179/80 with a break below this threshold putting the broader decline off the 2012 high into focus. Such a scenario looks to target support objectives at $1151/60, $1125 and $1091. Note that divergence has been identified in the daily momentum signature and suggests that a near-term correction higher may be in the cards as we open up 2014 trade. Bottom line: look to sell rallies / breaks of support with only a topside move surpassing $1268/70 threatening our medium-term directional bias. -MB

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx