Gold: $1181 Paramount for Bulls- Muted Recovery Ahead of U.S. NFPs

Fundamental Forecast for Gold: Neutral

Gold Plunges as Fed QE Reduction Bets Scatter Demand

Gold Could Get Interesting for a Turn Slightly Lower

Gold, Oil Look to US Data Set to Guide Fed Outlook

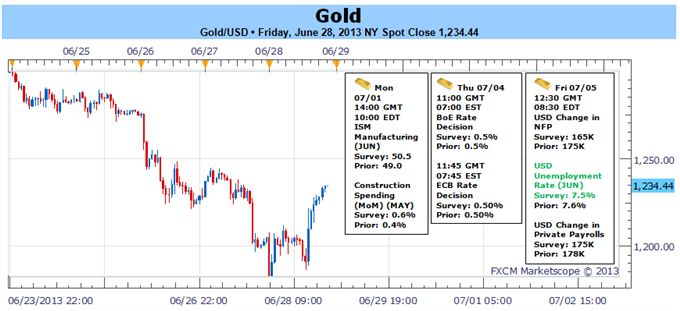

Gold continued its historic descent this week with prices plummeting through support at $1273 before settling around $1226 at the close of trade in New York on Friday. This week’s 5.4% decline pushes the quarterly losses to 31%, the largest quarterly decline seen in over 93 years. Despite the depth and swiftness of the decline, we will maintain a neutral bias on gold as we head into the close of the week, month and quarter with price action early next week likely to offer further conviction as to the next move in bullion prices.

As heightening turmoil in China and the lack of positive developments out of the EU summit drags on broader market sentiment, gold has remained at the mercy of the bears with prices breaking below key support earlier in the week. In light of the shift in the Fed’s policy outlook, the precious metal has continued to trade alongside broader commodities with risk-off flows offering no relief for the yellow metal. With that said, a renewed flight to safety may limit the topside in gold prices over the near-term with key event risk next week likely to offer clarity on a directional bias as we head into the second half of the year.

Looking ahead to next week the June non-farm payrolls report highlights the most significant event risk for gold. Indeed the US economy is expected to add another 165K jobs with the unemployment expected to narrow to an annualized 7.5% from 7.6% the previous month. We also will be closely watching the participation rate with larger fluctuations in the US civilian labor force having attributed to the volatility in the headline unemployment rate. On the back of last week’s FOMC policy meeting where Chairman Ben Bernanke reiterated that monetary policy remained ‘data dependent’ a strong NFP print may further fuel the argument to tapper asset purchases which would undoubtedly add to the downside pressure on the beaten commodity.

From a technical standpoint, gold tagged critical near-tem support at $1181 (actual low on Friday was $1180) before rebounding back above the 2009 highs at $1226 on Friday. The $1181 level represents the 161.8% extension from the decline off the May highs and remains key support for bullion. Momentum indicators do look a bit stretched here but with the July 4th holiday and key US employment data on tap next week, prices may lack direction as we kick off the third quarter. A break below $1180 targets a support range between $1160 and the 161.8% Fibonacci extension taken form the decline off the all-time record highs set back in 2011 at $1151. A recovery back above $1245 suggests a larger topside correction may be at hand with subsequent resistance targets seen at $1273 and the $1300 threshold. Bottom line: although the broader fundamental outlook remains bearish, we’ll stick to the sidelines ahead of key event risk next week and the July opening range. –MB

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx