German investor confidence improved strongly in September, suggesting robust economic activity despite political and economic risks such as the recent troubles of the banking sector, results of a key survey showed Tuesday.

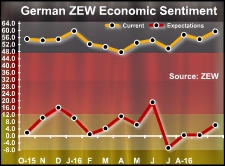

The ZEW Indicator of Economic Sentiment, which measures investors' expectations for the German economy in six months' time, rose to a four-month high of 6.2 from 0.5 seen in each of the previous two months, the Mannheim-based Centre for European Economic Research said.

Economists had expected a score of 4. The latest reading was the strongest since June's 19.2.

"The improved economic sentiment is a sign of a relatively robust economic activity in Germany," ZEW President Achim Wambach said.

"However, positive impulses from industry and exports should not distract from existing political and economic risks. In particular, the risks concerning the German banking sector are currently a burden to the economic outlook."

The current conditions index of the ZEW survey climbed to 59.5 from 55.1 in the previous month. The latest score was the highest since January, when it was 59.7.

The investor sentiment index for Eurozone also rose sharply, adding 6.9 points to reach a score of 12.3 points. In contrast, the current conditions index shed 2.3 points to touch minus 12.8 points.

The upbeat reading from the ZEW survey came on the heels of the strong export figures for August released by Destatis on Monday. The forecast-beating rebound in exports was the biggest increase in more than six years.

Exports grew 5.4 percent, which was the biggest gain since May 2010. The strong recovery came after a weak July.

Strengthening the picture of robust activity were the industrial production and factory orders data published last week. In contrast, private sector growth slowed to a 16-month low in September.

Meanwhile, economists are taking the news of strong recovery in the biggest euro area economy with a grain of salt.

"The headline ZEW index is still well below its long-run average of +24.2 and, based on its past loose relationship with annual GDP growth, points to a slowdown from Q3's rate of 1.7 percent to less than 1.0 percent," Capital Economics economist Jennifer McKeown said.

"It therefore supports the picture of a slowing economy painted by the Composite PMI over recent months rather than the message from the Ifo survey that growth is accelerating."

McKeown also pointed out the risk of worse to come if Deutsche Bank fails to reach a deal with the US Department of Justice to substantially reduce the fine that it has imposed for mis-selling mortgage securities.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Business News