Key Points

- The British Pound was under a lot of bearish pressure, as it declined below 141 against the Japanese yen.

- There was a triangle pattern on the hourly chart of GBPJPY, which was broken at 143.50 to initiate a downside.

- Today, the UK British Retail Consortium (BRC) Shop Price Index was published.

- The result was mixed, as there was a rise of 1% in Dec 2016, compared with the previous month.

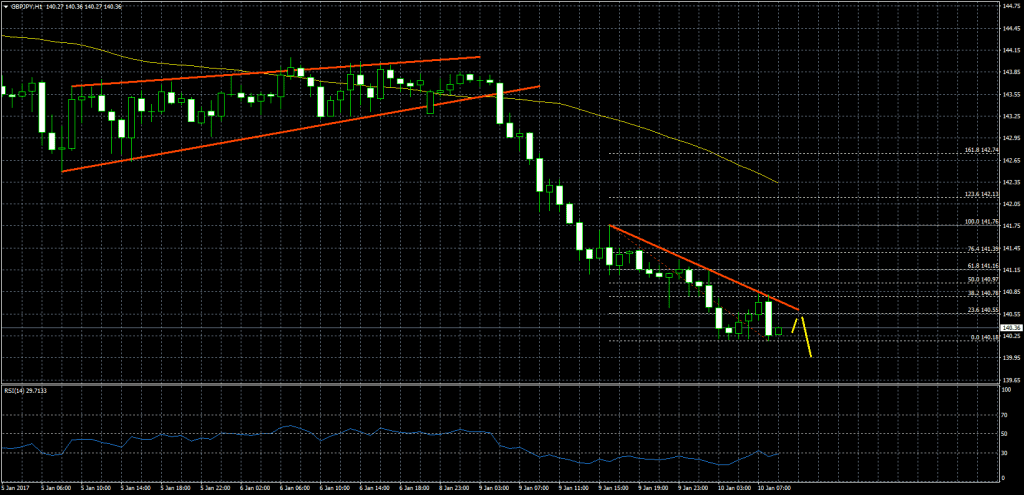

GBPJPY Technical Analysis

The British Pound declined heavily against the Japanese yen recently, as there was a break below the 21 hourly simple moving average at 143.50. Earlier, the GBPJPY pair also broke a triangle pattern on the hourly chart at 143.50 to clear the downside wave.

Later, the pair moved sharply lower, and broke the 141.00 support area. The pair is currently in a downtrend and looks set for more declines towards 140.00.

On the upside, there is a bearish trend line, which is acting as a resistance near 140.80, and can be considered as a sell zone.

UK British Retail Consortium (BRC) Shop Price Index

Today during the London session, the British Retail Consortium (BRC) Shop Price Index, which measures price changes in the popular retail outlets in the UK was released. The market was aligned for no major change in the index in Dec 2016, compared with the previous month.

The result was mixed, as there was a rise of 1% in Dec 2016, compared with the previous -1.4%. The report added that “Online sales of Non-Food products in the UK grew 7.2% in December versus a year earlier, when they had increased by 15.1%. This is the first growth below 10% in four months. December’s growth was below the 3-month average of 9.5% and the 12-month average of 10.0%”.

Overall, it looks like there is hardly any reason for the GBP buyers to step in, which means more losses in GBPJPY are possible towards 140.00.