Key Points

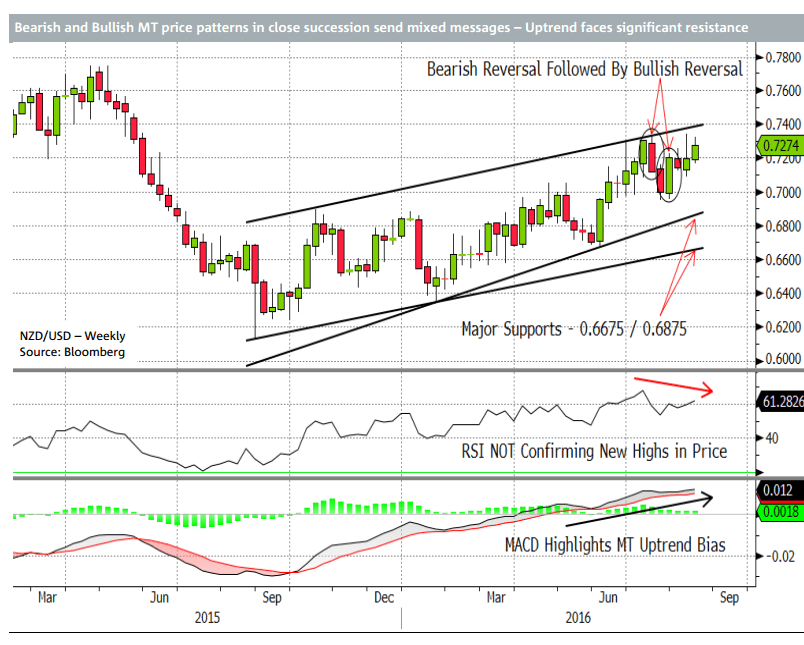

- The British Pound traded higher against the Japanese yen before finding sellers near 132.25.

- The GBPJPY pair is currently correcting lower, but may find support near a bullish trend line formed on the hourly chart.

- In the UK today, the Net Borrowing report was released by the National Statistics.

- The outcome was positive, as the Net Borrowing came in at £-1.472B in July 2016, compared with the forecast of £-1.200B.

GBPJPY Technical Analysis

The British Pound recently traded higher against the Japanese yen to test the 132.25 resistance where sellers appeared. The GBPJPY pair is currently correcting lower, but it may find support on the downside as there is a bullish trend line formed on the hourly chart.

Moreover, the 21 hourly simple moving average is also on the downside waiting to act as a support along with the 50% Fib retracement level of the last wave from the 130 low to 132.25 high.

So, buying around the support area on the downside may be considered as long as the pair is above the trend line.

UK Net Borrowing

Today during the London session, the Net Borrowing, which captures an amount of new debt held by the U.K. governments (the financial deficit in the UK national accounts) was released by the National Statistics.

The market was expecting a reading of £-1.200B in July 2016, but the result was better as it came in at £-1.472B. Adding on the report, the National Statistics pointed out that “This is the second successive month of debt falling on the year as a percentage of GDP and indicates that GDP is currently increasing (year-on-year) faster than net debt excluding public sector banks. However, care should be taken when inferring trends from only two months’ data, especially given the provisional nature of centered GDP estimates for the latest month”.

The GBPJPY pair is currently correcting lower, but it is likely to find buyers on the downside around the 21 hourly SMA.