Key Points

- The British Pound bounced and traded above the 1.2400 resistance against the Swiss Franc.

- There was a break above a bearish trend line with resistance at 1.2390 on the hourly chart of GBPCHF.

- Today, the UK’s Retail Sales numbers for Feb 2017 were released by the National Statistics.

- The result was above the forecast, as the Retail Sales posted an increase of 1.4% in Feb 2017 (MoM), more than the +0.4% forecast.

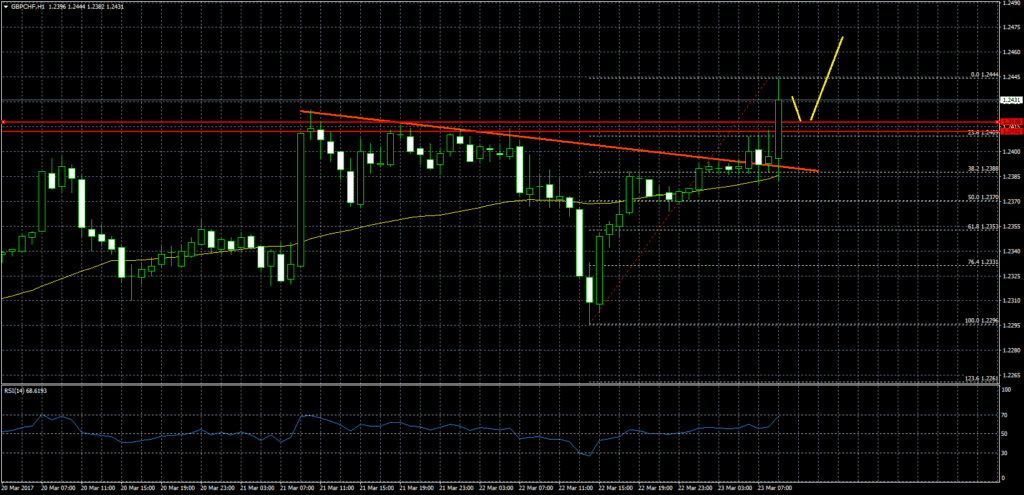

GBPCHF Technical Analysis

The British Pound recovered well from the 1.2296 low against the Swiss Franc, and moved above the 1.2320 resistance area. There was also a close above a bearish trend line with resistance at 1.2390 on the hourly chart of GBPCHF.

The pair also managed to move above the 21 hourly simple moving average, and a major resistance area near 1.2410. There was a new high at 1.2444 from where the pair is correcting lower.

So, if the pair moves down, the broken resistance area near 1.2400-1.2410 might act as a support zone in the short term.

UK Retail Sales

Today in the UK, the Retail Sales numbers for Feb 2017 were released by the National Statistics. The market was expecting the sales to increase by 0.4% in Feb 2017, compared with the previous month.

The outcome was above the forecast, as the Retail Sales posted an increase of 1.4% in Feb 2017 (MoM). In terms of the yearly change, the forecast was +2.6% in Feb 2017, but the outcome was better, as there was a rise of +3.7%. The report added that “Average store prices (including fuel) increased by 2.8% on the year, the largest growth since March 2012; the largest contribution came from petrol stations, where year-on-year average prices rose by 18.7%”.

Overall, the British Pound remains in an uptrend, and could trade past 1.2450 against the Swiss Franc in the near term.