Key Points

- The British pound traded consistently higher against the Swiss Franc recently and moved above the 1.2600 resistance.

- There are many support trend lines on the downside at 1.2620-1.2600 on the hourly chart of GBPCHF.

- Today, the Switzerland Trade Balance figure was released by the Federal Customs Administration.

- The result was below the forecast, as the trade surplus was 2.716M in Dec 2016, compared with the 2,810.0M forecast.

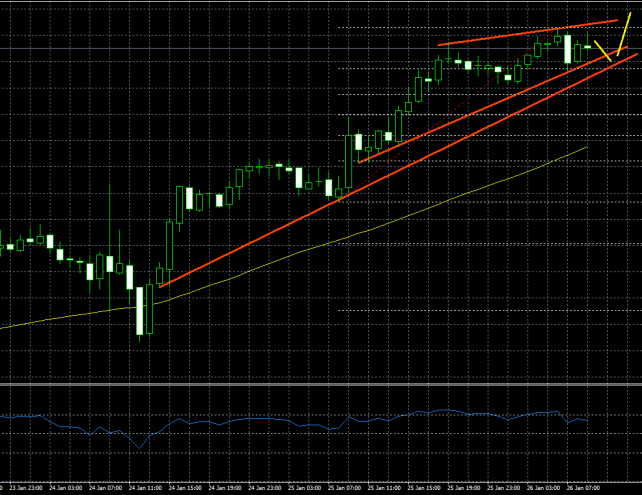

GBPCHF Technical Analysis

The British Pound traded higher and managed to climb above the 1.2600 handle against the Swiss Franc. The GBPCHF is in a solid uptrend, and has support trend lines on the downside at 1.2620-1.2600 on the hourly chart.

The pair made a nice upside move recently, breaking a lot many hurdles like 1.25 and 1.26. The trend may continue, and gains could extend once there is a break above the 1.2650 swing high.

On the downside, there is a trend line support at 1.2620, followed by 1.2600 where one may consider buying with a stop of a close below 1.2600.

Switzerland Trade Balance

Today, the Switzerland Trade Balance, which is a measure of balance amount between import and export was released by the Federal Customs Administration. The market was looking for a trade surplus of 2,810.0M in Dec 2016.

However, the result was below the forecast, as the trade surplus was 2.716M in Dec 2016. The report stated that “Following a decline the previous year, foreign trade grew again in 2016, with chemicals and pharmaceuticals shaping the trend. Exports climbed by a total of 3.8% (real: -0.8%) to a record high of CHF 210.7 billion”.

Overall, it looks like the GBPCHF pair may continue to trade higher. Only a break and close below 1.2600 could ignite a downside move.