Last week we examined whether Sterling is cheap on a valuation basis, given recent sharp falls.

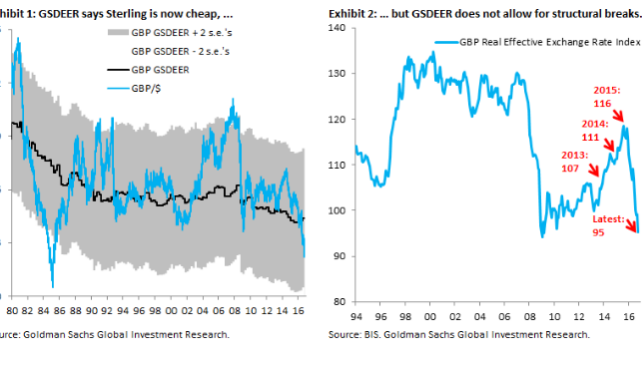

Our starting point was that standard valuation models – such as our own GSDEER – are not well suited to address this question. This is because these models, which essentially amount to slow moving averages of the exchange rate (controlling for terms of trade shocks and productivity differentials), do not adjust for the kind of structural break that the referendum and potential for a “hard”Brexit surely represent. Indeed, Exhibit 1 shows our own GSDEER fair value (black line) with two standard deviation error bands (grey area). It shows that GBP/$ is slightly more than one standard deviation cheap at this point, given that Cable has plunged while GSDEER fair value is essentially unchanged. The signal that Sterling is cheap therefore ignores the ructions that Brexit may cause for the UK economy and – potentially – a drop in fair value.

As a result, we use a different approach, which calculates the depreciation needed to bring the current account to a new, post-Brexit equilibrium. That approach says that GBP needs to fall between 20-40 percent from pre-Brexit levels, so the declines since June (Exhibit 2) have only brought us to the lower bound of this range.

Our main result is that – even with the large declines that have already occurred – the trade-weighted Pound is still around 10 percent overvalued if a smaller current account deficit is the norm going forward.

In short, Sterling is still not yet cheap.

Copyright © 2016 Goldman Sachs, eFXnews™Original Article