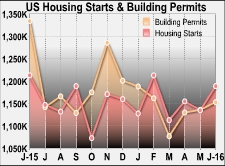

After a relatively quiet calendar on Monday, the economic docket picks up today with (amongst others) CPI, RPI and PPI numbers from the UK; Zew survey from the EZ; and US housing starts this afternoon.

In the UK inflation is expected to have remained unchanged for the month of June, although ticking up marginally to 0.4% on the Y/Y count. Overall the GBP’s daily performance remains consistent and steady, albeit softer against the EUR, USD and the JPY, GBP was seeing some gains against the commodity-bloc currencies this morning.

GBPUSD is in the red today but GBP was able to defend yesterday’s lows of 1.3187 so far, GBPUSD is currently trading a price of 1.3222. Yesterday BoE policy member, Martin Weale, was quoted as saying that he was unsure about an August rate cut.

Despite the positive US handover, Asia was mostly lower with technology leading the selloff. The yen is seen paring back some of yesterday’s losses to the USD, sp far today. Speculation of more easing out of the BoJ has recently led to weakness in the Japanese Yen. The Japanese Central Bank is expected to ease in its next policy review meeting on July 29th.

The euro was close to flat against the USD this morning as we head closer to Thursday’s ECB meeting. In early morning trade the kiwi sold off agressively against its major peers, after the Reserve Bank of New Zealand released a consultation paper aimed at imposing restrictions on home loans as it steps up efforts to tame the housing market.