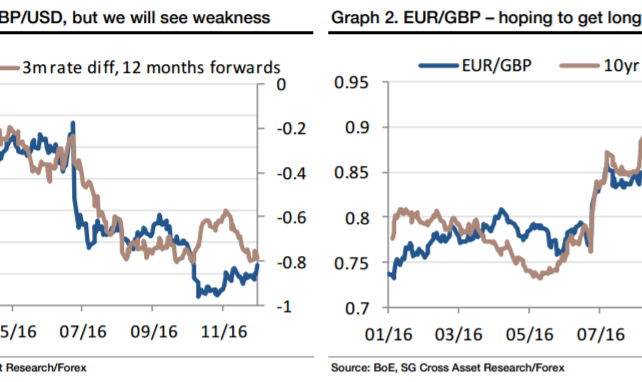

Sterling fell pretty much pari passu with interest rate expectations after the vote to leave the EU in June. If we look at 3m futures contracts, there’s been a 60bp shift in relative pricing of where rates will be in a year’s time that reflects consensus now that fed funds will be at 1-1.25% in December 2017, while UK rates will be unchanged at 0.25%. This is in line with our forecasts and points to a period of relative calm for the pound (which is currently seeing some much-needed short-covering) before the economic implications of leaving the EU become clearer.

We will fade any short covering. A period of calm, however, can turn into renewed weakness if the squeeze on real incomes undermines the recovery in economic confidence and upward revisions to growth forecasts.

So while we expect GBP/USD to trade only slightly lower on a 12m view, we are wary of spikes below 1.20 and expect to see a temporary return to 1.15 at some point.

Brexit will hurt eventually. If we do see resilience for sterling through 1Q, as UK data hold up, and if we also see the euro trade down to parity with the dollar over that timescale, we would look to buy EUR/GBP for a sharp rebound in 2Q-3Q as UK growth suffers from higher inflation, and the political headwinds facing the euro fade. A return to levels above EUR/GBP 0.90 is very possible in 2017.

*SocGen maintains a short GBP/USD position in its portfolio from 1.2590.

*This trade is recorded in eFXplus Orders.

Copyright © 2016 Societe Generale, eFXnews™Original Article