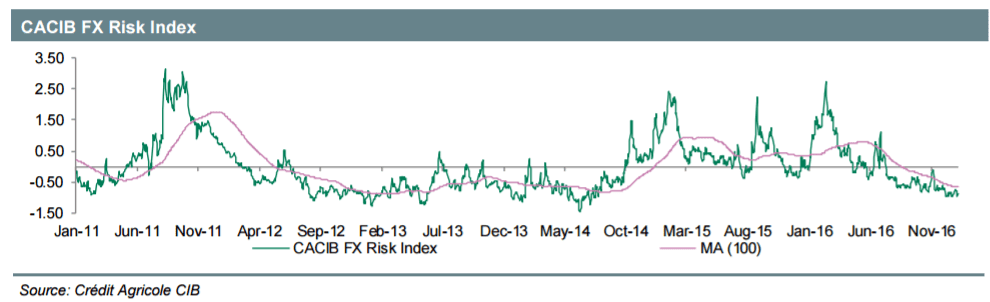

At -0.87 (vs -0.97 on 22 December 2016) our Risk Index has moved into less risk seeking territory. The latest development was well reflected in widening credit spreads and rising demand for defensive stock market sectors such as utilities. Cross market volatility, in contrast, fell.

From a broader perspective the index remains indicative for firm risk appetite, which is unlikely to change unless global growth expectations start to soften from here. In that respect the main focus should be on the US still where further improving conditions may be required in order to compensate for tighter monetary conditions’ dampening impact on appetite for risky assets.

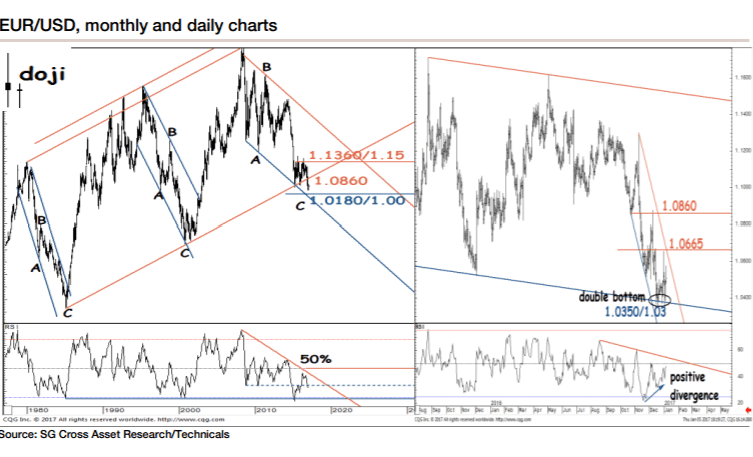

In G10 FX, the USD keeps a positive correlation to risk sentiment. In light of the above outlined conditions dips should still be regarded as a buy, mostly against commodity currencies and the EUR.

Copyright © 2017 Credit Agricole CIB, eFXnews™Original Article