The dollar scaled back some of its early gains on Wednesday as sterling held firm on the eve of Britain's referendum on whether to remain in the European Union.

Recent opinion polls have shown a shift towards a win from the 'Remain' camp in the UK's EU referendum. However the race still seems too close to call as momentum has stalled slightly for the 'In' camp.

USD/JPY nudged up above 105 briefly before retreating to 104.45, and is down a quarter of a percentage point at the time of writing.

The greenback was supported overnight, after Federal Reserve Chair Janet Yellen held her stance of "gradual increases" in US rates on Tuesday.

In her testimony before Congress, Yellen expressed general optimism about the US economy and said gradual hikes in the federal funds rate were likely to be needed. However, she stressed the economic outlook was uncertain and that monetary policy was "by no means on a preset course".

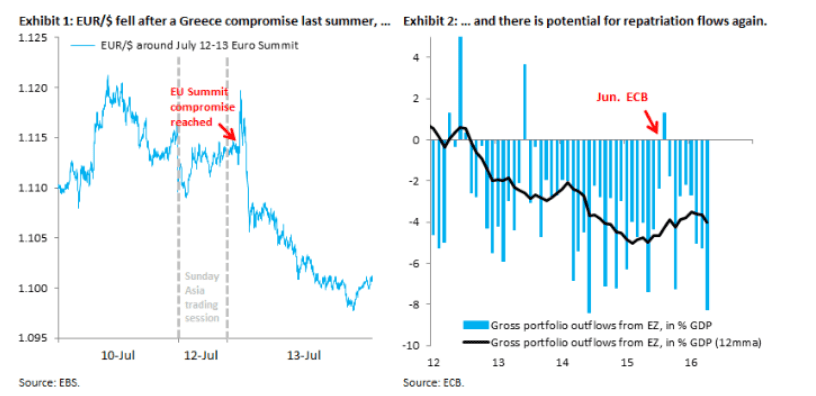

EUR/USD was up 0.2 percent to 1.1275 on Wednesday, from 1.1236 earlier. GBP/USD was flat at 1.4662 as it consolidates just short of a six-month high by 1.4788 after rising more than 700 pips since last Thursday.

Commodity currencies also took a step back but then rebounded after WTI crude oil rose above $50 per barrel following an unexpected draw in US stock piles. The Aussie trades near its session high by 0.7490 while USD/CAD is down slightly below 1.2800.