Fundamental Forecast for New Zealand Dollar: Bullish

NZD/USD Pops Through Top of Range and Reverses

NZDUSD Clears Key Channel Support

NZD/USD Classic Technical Report 11.30.2012

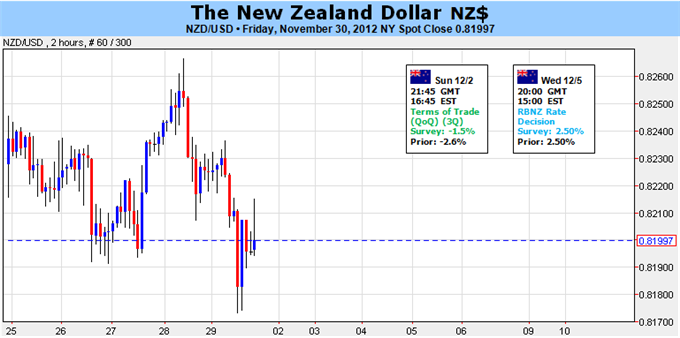

The New Zealand dollar pared the rebound from earlier this month after tagging a fresh high of 0.8266, but the recent weakness in the higher-yielding is likely to be short-lived as the Reserve Bank of New Zealand (RBNZ) preserves a neutral policy stance. Indeed, the economic data on tap for the following week may push the kiwi higher ahead of the interest rate decision as we’re expecting to see a small improvement in the terms of trade along with a marked increase in building activity, and a slew of positive developments may lead the NZDUSD to threaten the November high (0.8307) as it dampens speculation for a rate cut.

According to a Bloomberg News survey, all of the 16 economists polled see the RBNZ keeping the benchmark interest rate at 2.50%, and central bank Governor Graeme Wheeler may continue to tame expectations for additional monetary support amid the expansion in private sector credit. Although the central bank head continues to highlight the ongoing slack within the real economy, the rebuilding efforts from the Christchurch earthquake may start to fan fears of an asset bubble amid record-low borrowing costs, and Governor Wheeler may signal a need to raise the cash rate in 2013 amid rising home prices. As the slowdown in global growth hampers the near-term outlook for the export-driven economy, the RBNZ remains poised to carry its wait-and-see approach into the following year, but we will be keeping a close eye on the policy statement as Mr. Wheeler warns of impending risks to the region. In turn, the fresh batch of central bank rhetoric may encourage a bullish forecast for the New Zealand dollar, and we may see the kiwi outperform against its major counterparts over the coming months amid the shift in the policy outlook.

As the 10, 20, 50, and 100 day moving averages continue to converge with one another, the formation suggests that the NZDUSD may continue to face range-bound prices over the near-term, but a less dovish statement from the RBNZ may trigger a move above 0.8300 – the 23.6% Fibonacci retracement from 2010 low to the 2001 high – as market participants curb bets for lower borrowing costs. – DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx