Fundamental Forecast for Japanese Yen: Bullish

USDJPY Trading Near Critical Support

USDJPY Long Trade Profits Booked

Japanese Yen Declines in Store

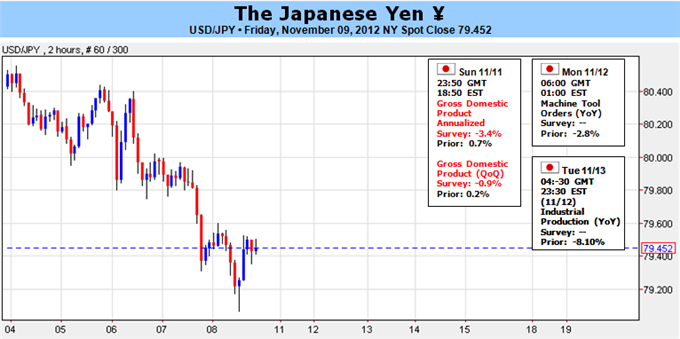

Japanese Yen Declines in StoreThe Japanese Yen snapped back against its major counterparts, with the USDJPY slipping to a fresh monthly low of 79.06, and the low-yielding currency may appreciate further next week as positive real interest rates in Japan continues to increase the appeal of Yen. Indeed, the dovish remarks by the Bank of Japan (BoJ) failed to weaken the local currency even as Governor Masaaki Shirakawa pledged to tackle the ongoing threat for deflation, and the central bank is likely to come under increased pressure to shore up the ailing economy as the GDP report is expected to show the growth rate contracting 0.9% in the third-quarter.

Despite the recent efforts taken by the BoJ – the additional JPY 11T in quantitative easing along with the unlimited borrowing program for commercial banks – members of the Liberal Democratic Party argued that the board should embark on its easing cycle until price growth climbs to an annual rate of 3%, and we may see a growing number of central bank officials call for a currency intervention in an effort to shore up inflation expectations. As the region faces a growing threat for a double-dip recession, with the BoJ struggling to achieve its 1% target for inflation, the government may have greater influence on monetary policy as Economy Minister Seiji Maehara continues to accompany the central bank meetings.

However, as the central bank anticipates the new initiatives to stimulate private-sector activity, the BoJ may continue to rely on its asset purchase program to tackle the downside risks surrounding the economy, and Governor Shirakawa may see limited scope for a currency intervention as the previous attempts have failed to have a lasting impact. With two meetings remaining for the rest of the year, there’s growing speculation that the BoJ will take additional steps in December, but the efforts may have a limited impact in weakening the local currency as it retains its appeal in the low-yielding environment.

As the flight to safety appears to be gathering pace, the shift in market sentiment should prop up the Yen next week, while positive real interest rates in Japan instills a bullish outlook over the near to medium-term as central banks across the global maintain a highly accommodative policy stance. In turn, the short-term reversal in the USDJPY may continue to take shape in the days ahead, and we may see the pair work its way back below the 78.00 figure as it carves out a short-term top in November. – DS

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx