EUR/USD – BEARISH BIAS – (1.0800-1.1300)

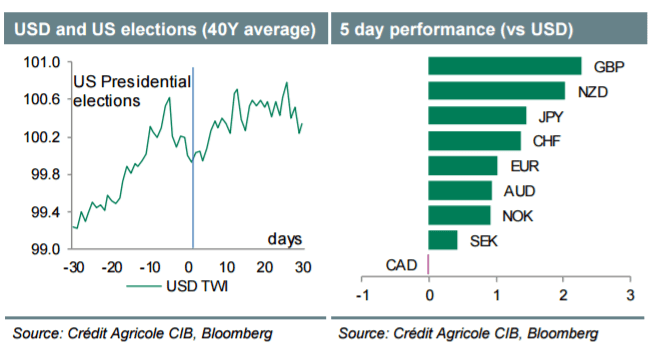

The euro has strengthened against the US dollar over the last week rising back above the 1.1000-level. It has been mainly driven by a weakening of the US dollar in the run up to the US Presidential election on the 8th November. The latest opinion polls have revealed that Hillary Clinton’s lead has continued to narrow following the re-opening of the FBI probe. It has prompted the market to price in more of a political risk premium into the US dollar to reflect the higher likelihood of Donald Trump becoming President. Still at the current juncture it appears likely that Hillary Clinton will become President which remains our base case scenario.

A victory for Hillary Clinton would result in the US dollar rebounding in the week ahead as the focus switches back to Fed policy.In contrast, a shock victory for Donald Trump could trigger a sharp US dollar sell off potentially delaying the resumption of Fed rate hikes.

USD/JPY – NEUTRAL BIAS – (100.50-104.00)

USD has been weakening, hit by the FBI investigation right before the US presidential election. The November BoJ and FOMC meetings this week did not result in any surprises. USD strengthening pressure has been diminishing.

Japanese investors are unlikely to make any big moves ahead of US Elections. The recent drop in oil prices may push USD/JPY lower.

If Clinton wins next week, USD may return to the recent high, but no stronger. If Trump wins, the surprise could cause USD/JPY to fall below the lower bound 100.50.

Copyright © 2016 BTMU, eFXnews™Original Article