Key Points

- The Euro after trading towards 1.1020 against the US Dollar found sellers and moved down.

- The EURUSD pair moved down and recently broke a major support area at 1.0940 and a bullish trend line at 1.0930 on the hourly chart.

- In the Euro Zone, the German Industrial Production for March 2017 was released by the Statistisches Bundesamt Deutschland.

- The result was a bit better than the market forecast, as the German Industrial Production declined 0.4%, less than the forecast of -0.6%.

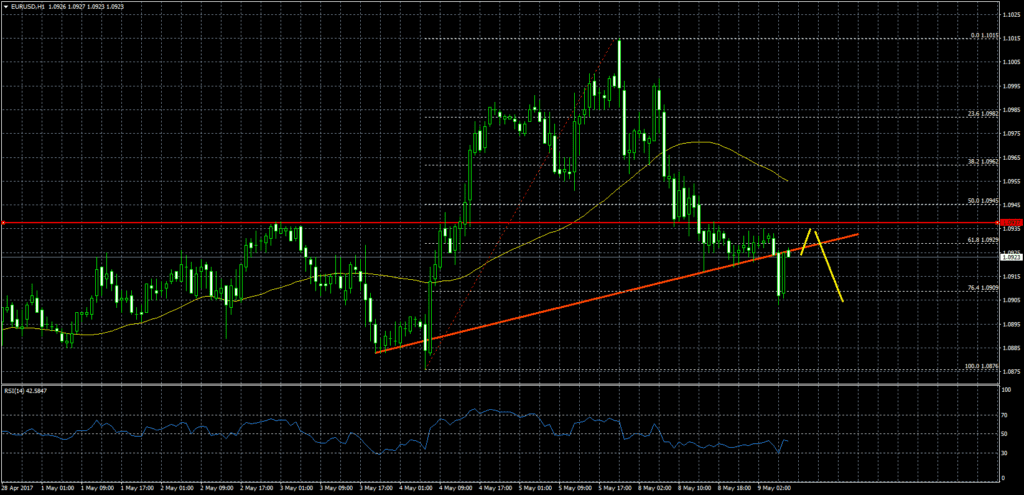

EURUSD Technical Analysis

The Euro had a good run recently, as it moved towards 1.1020 against the US Dollar, but later found resistance and moved down. During the downside move, the EURUSD pair broke the 21 hourly simple moving average and the 38.2% Fib retracement level of the last wave from the 1.0876 low to 1.1015 high.

The pair also cleared a major support area at 1.0940 and a bullish trend line at 1.0930 on the hourly chart.

At the moment, the pair is bouncing from the 76.4% Fib retracement level of the last wave from the 1.0876 low to 1.1015 high, but may soon find sellers and move down again.

German Industrial Production

Recently in Euro Zone, the German Industrial Production for March 2017 was released by the Statistisches Bundesamt Deutschland. The forecast was lined up for the German Industrial Production to decline by 0.6% in March 2017, compared with the previous month.

The result was a bit better than the market forecast, as the German Industrial Production declined 0.4%, less than the forecast of -0.6%. The report added that “production in industry excluding energy and construction was down by 0.5%. Within industry, the production of capital goods decreased by 1.2%. The production of consumer goods remained at the same level of the previous month”.

Overall, the EURUSD may extend its decline in the near term and could even test the 1.0880 support.