Key Points

- The Euro after finding support near the 1.0590 level against the US Dollar started a recovery.

- The EURUSD pair is currently attempting to break a major bearish trend line at 1.0630-40 on the hourly chart.

- Earlier today, the Germany consumer price index for Jan 2017 was released by the Statistisches Bundesamt Deutschland.

- The result was around the forecast, as the CPI increased by 1.9% in Jan 2017 (YoY), just as the last reading.

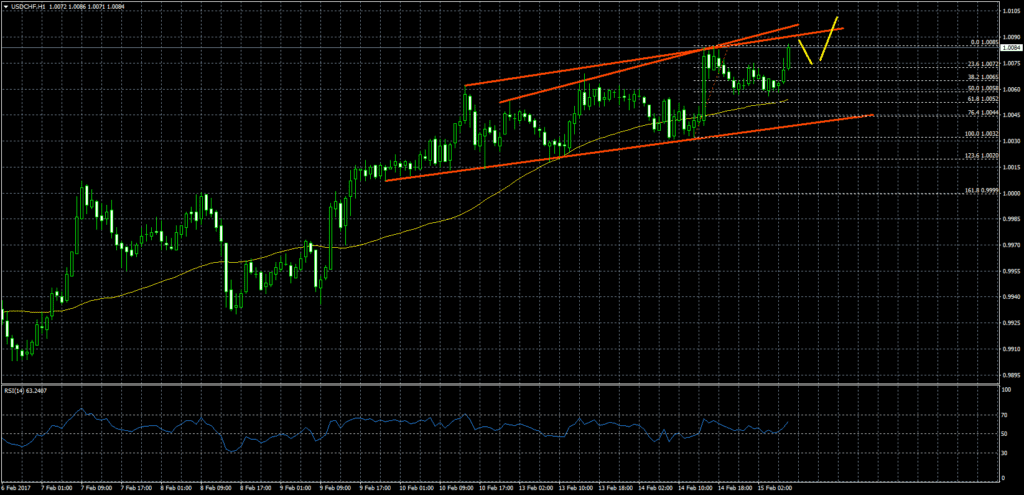

EURUSD Technical Analysis

The Euro was under a lot of pressure lately against the US Dollar, and it broke the 1.0680 support to trade as low as 1.0592 where it found support. After trading in a range for some time, the EURUSD pair started a recovery.

However, the recovery is facing a major bearish trend line at 1.0630-40 on the hourly chart. Moreover, the 38.2% fib retracement level of the decline from the 1.0711 high to 1.0592 low is also above the trend line resistance.

Lastly, the 21 hourly simple moving average is also at 1.0625. All in all, there are many hurdles at the moment for more gains in EURUSD above 1.0640.

German Consumer Price Index

Today in the Euro Zone, the German Consumer Price Index report was released by the Statistisches Bundesamt Deutschland. The market was expecting a rise of 1.9% in Jan 2017, compared with the same month a year ago.

The result was around the forecast, as the CPI increased by 1.9% in Jan 2017, which was also similar to the last reading. When we look at the monthly change, the market was expecting a decline of 0.6% in Jan 2017, compared with the previous month. Again, the result was as expected. The report added that the “year-on-year increase in energy prices was considerably higher than in December 2016 when the relevant rate of price increase had been +2.5%. In January 2017, especially mineral oil products were more expensive than a year earlier (+18.1%, of which heating oil: +42.5%; motor fuels: +12.8%)”.

Overall, it won’t be easy for the Euro to break the highlighted trend line resistance at 1.0640.