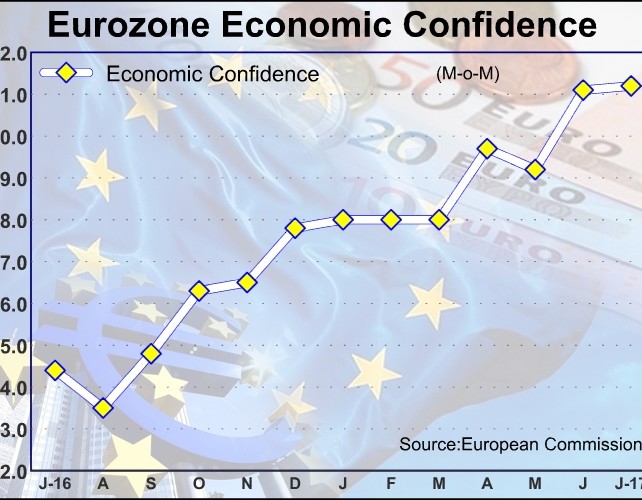

Eurozone economic confidence strengthened unexpectedly in July to near a decade-high, survey data from the European Commission showed Friday.

The economic sentiment index rose slightly to 111.2 in July from 111.1 in June. The score was forecast to fall to 110.8. This was the highest score since the 2007 financial crisis.

The ESI supports the assessment that the euro-zone economy will expand by an above-consensus 2.2 percent this year, Jack Allen, an economist at Capital Economics, said.

But with core inflation still subdued, the European Central Bank is likely to proceed with caution, he added.

The International Monetary Fund upgraded the Eurozone growth outlook earlier this week, citing stronger momentum in domestic demand than previously anticipated.

Gross domestic product is forecast to grow 1.9 percent this year and 1.7 percent in 2018. The projections were revised from 1.7 percent and 1.6 percent, respectively.

The survey results showed that the industrial confidence indicator held steady at 4.5 in July, slightly above the forecast of 4.4 points. The flat change was caused by managers' virtually unchanged assessments of all components entering the confidence indicator.

At the same time, the services confidence index rose to 14.1 from 13.3 in June. The increase in services confidence owed exclusively to markedly higher demand expectations and managers' views on past demand.

The confidence index in retail trade fell to 4.0 in July from 4.4 in the previous month. Retail trade confidence showed a mild deterioration largely due to worse than expected business situation.

The consumer sentiment index declined to -1.7, in line with the flash estimate, from -1.3 a month ago. The weakness reflected lower savings expectations and less optimistic views about future unemployment, which were only partly offset by more upbeat appraisals of the future general economic situation.

Separate data from EU showed that the business confidence index fell to 1.05 in July from 1.16 in June. The expected reading was 1.14.

While managers' production expectations, as well as their appraisals of overall order books and the stocks of finished products remained broadly stable, their views on export order books and, in particular, past production deteriorated.

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.