Gold steadied on Thursday, after slipping 0.3 percent in the prior session, as the dollar stayed under pressure and forex investors awaited cues on monetary stimulus from a European Central Bank policy meeting due today.

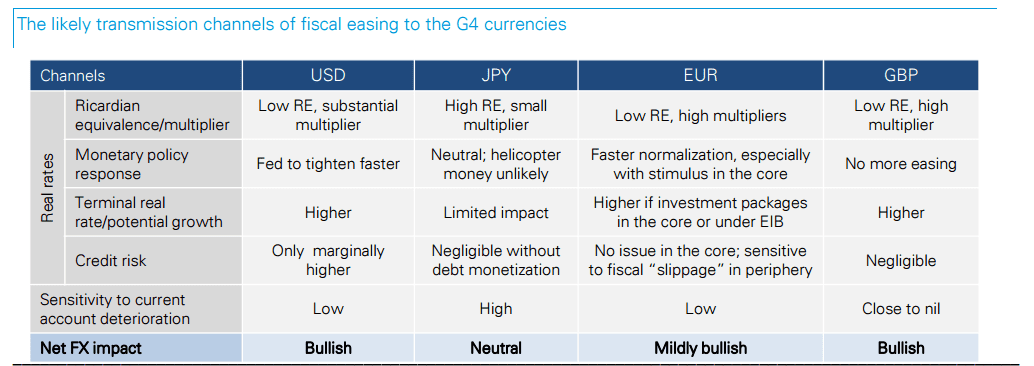

The euro zone economy is widely expected to need more stimulus from the European Central Bank (ECB), but it may not come at the bank's policy meeting on Thursday.

The Japanese yen held firm on Thursday as traders focused on a speech by Bank of Japan Deputy Governor later in the day for any hints of what policymakers may decide in the policy review next week.

USD/JPY fell to 101.20 on Wednesday, hitting its lowest level since August 26th and today trades around 101.60. The yen was up as much as 2.1 percent versus the dollar so far this week as the buck lost momentum on soft US economic data.

The dollar has been weighed by slightly disappointing jobs numbers last Friday and a surprisingly soft service sector survey on Tuesday which have cast doubt about the Federal Reserve's ability to raise interest rates soon despite hawkish rhetoric from Fed officials.

EUR/USD edged lower to 1.1233 from Wednesday's high of 1.12725. The euro held firm as forex investors looked to whether the ECB would decide to extend its asset purchase program and tweak the parameters to ease supply scarcity issues, at its policy meeting later in the day.

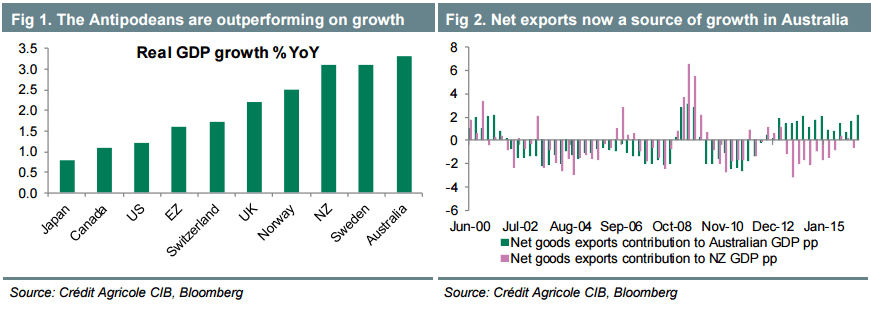

Elsewhere, the kiwi dollar held at 0.7454 after having hit a 16-month high of 0.7485, supported by strong prices of dairy, a major export earner.