U.S. bond yields slipped on Monday, weighing on the dollar against the yen, as the euro struggled to find momentum after suffering significant losses at the end of last week on renewed concerns about the upcoming French elections.

Markets, already nervous over the possibility of a win for far-right, anti-European Union candidate Marine Le Pen, were jolted after two French hard-left candidates late on Friday said they were discussing cooperation in their bid for the country's presidency.

After two French hard-left candidates said they were discussing a possible cooperation, markets jittered as a unified left-wing front could push the centrist vote to shift towards Le Pen's National Front.

USD/JPY was up to 113.15, still close to 112.620, its lowest since Feb. 9 touched on Friday.

EUR/USD climbed up 0.1 percent to 1.0620 after slipping 0.6 percent on Friday. The common currency nudged up half a percent to 120.25 after slumping to an 11-day low of 119.650. It had slipped nearly 1 percent on Friday against the yen.

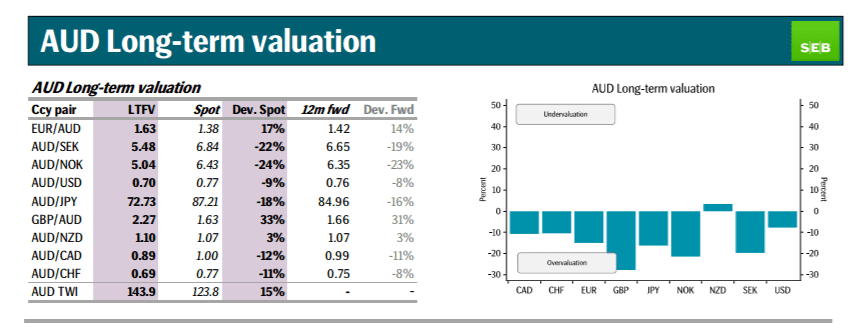

AUD/USD was buoyed and up to 0.7675 and still in touch of a 3-1/2 month high of 0.7732 scaled last week.

The Aussie has enjoyed steady support this year from a surge in the price of iron ore, the country's chief export. But uncertainty regarding the country's monetary policy and economic performance has prevented the currency from making further gains.

Kiwi was flat around 0.7180 versus the greenback. Focus was on Wednesday's global dairy price auction. The New Zealand dollar is sensitive to the price of milk, New Zealand's top export product.