Euro Needs Signs of Continued Economic Recovery Before Next Rally

Fundamental Forecast for Euro: Neutral

Slowing growth momentum in Europe is hurting the European currencies.

Retail forex traders remain net-short the EURUSD.

The European Central Bank’s policy will let the Euro rally if data improves.

The Euro had a mixed week as US fiscal headlines were the main focus of price action across asset classes around the globe. The commodity currencies benefited most as the veiled threat of a US default was seemingly lifted into the weekend, and the Euro lost -0.45% and -0.16% to the Australian and New Zealand Dollars respectively. The EURUSD closed lower by -0.10% but recovered some on Friday, suggesting that easing US fiscal tensions could ultimately play into the Euro’s favor.

In the wake of the US fiscal deadlock breaking, as signs currently point to a short-term (six-week) resolution that will raise the debt limit and reopen the government sometime early next week, near-term focus will shift to the inevitable continuation of QE3 at its current $85B/month pace when the Federal Reserve meets later this month. This will help keep the US yield curve flatter from October through December than it otherwise would have been if QE3 were tapered in October, acting as a weight on the US Dollar (as it has since the Fed’s non-taper in September).

The Euro, unlike the US Dollar, is no longer dealing with a central bank insistent on excess monetary easing unless absolutely necessary. Earlier this month, the ECB suggested that it would only implement another LTRO if crisis conditions were to re-arise, and therefore the lull in economic activity coming out of the summer months should be viewed as a natural, near-term lull in the business cycle.

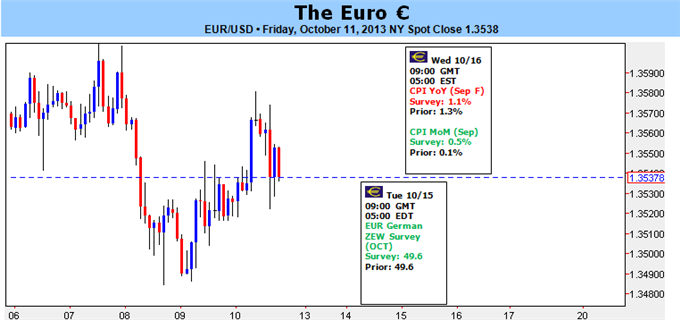

This week, data scheduled to be released will show the extent of slowing economic momentum and if a reacceleration has begun. This will be revealed between the October ZEW surveys released on Tuesday and the September Euro-Zone inflation data on Wednesday (unfortunately, we’ll need to wait until Wednesday’s inflation data before Tuesday’s ZEW surveys can have proper context).

September Euro-Zone inflation is expected to have accelerated in the near-term but remain significantly dampened on a yearly basis. Consensus forecasts compiled by Bloomberg News show that economist expect the monthly Consumer Price Index reading to increase to +0.5% from +0.1%, although the yearly reading is due to decline to +1.1% from +1.3%. Concurrently, the core reading – stripped of the more volatile food and energy components – is due on hold at +1.0% y/y.

These figures paint a dim picture on the yearly side but the monthly figure, if achieved, would suggest that growth me be on the mend. This will of course be illustrated a day earlier in the Euro-Zone and German ZEW surveys, which are expected on hold or to improve modestly. It would be best for the Euro if both of these data sets – the ZEW surveys and the CPI – show a steadying or modest improvement in the near-term to restore faith that the Euro-Zone crisis is over. A weak outlook forecasted by the ZEW surveys coupled with further disinflation will raise the stakes for further accommodation by the ECB (not necessarily another LTRO), which could prove EUR-negative.

With UK economic growth momentum seemingly moderating as well, there is a case to be made the upswing in overall European growth may be past its apex for 2013. But as long there are signs of a continued economic recovery, the Euro will have the opportunity to rally with the ECB remaining on the sidelines. –CV

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx