Key Points

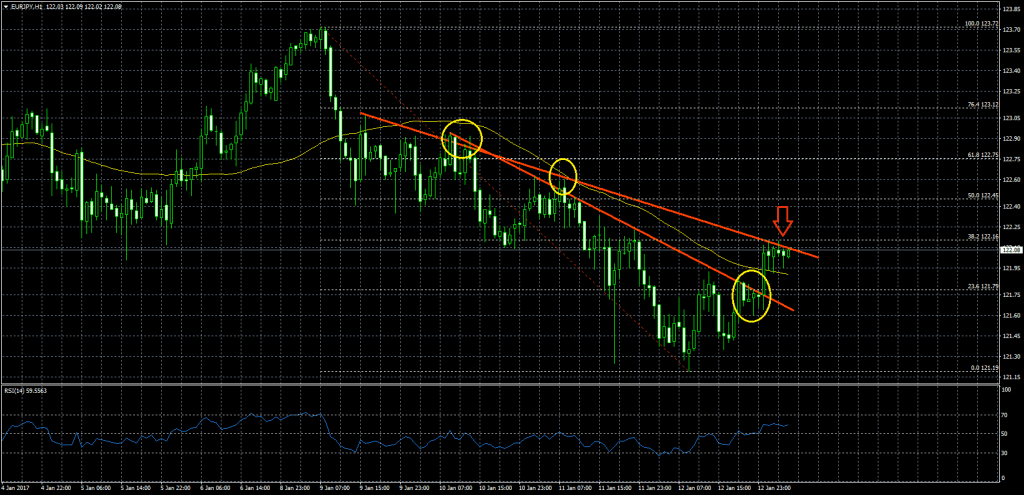

- The Euro after a downside move towards 121.19 against the Japanese yen started recovering.

- There are two bearish trend lines on the hourly chart of EURJPY, out of which one is cleared and the pair is attempting to clear another at 122.15.

- Today, the Japanese Money Supply M2+CD was released by the Bank of Japan.

- The result was around the expectation, as there was a rise of 4% in Dec 2016, compared with the same month a year ago.

EURJPY Technical Analysis

The Euro recently declined against the Japanese yen for a move towards 121.20 where it found support. Later, the EURJPY pair moved higher, and broke a bearish trend line on the hourly chart at 121.80 along with the 21 hourly simple moving average.

The pair at the moment attempting to clear another bearish trend line at 122.15, which is also positioned with the 38.2% Fib retracement level of the last decline from the 123.72 high to 121.19 low.

If the pair succeeds in breaking the highlighted trend line resistance near 122.15, a move towards 122.45 is possible.

Japanese Money Supply M2+CD

Today during the Asian session, the Money Supply M2+CD, which measures all the JPY in circulation, encompassing notes and coins as well as money held in bank accounts was released by the Bank of Japan.

The result around the forecast, as there was a rise of 4% in Dec 2016, compared with the same month a year ago. Moreover, the Securities investment, released by Ministry of Finance posted a reading of ¥206.5B, compared with the last ¥-501.4B.

In short, the Euro has a good chance of breaking the second bearish trend line and move past 122.20 in the near term. If it fails, there can be a retest of 121.80.