Key Points

- The Euro traded higher against the Japanese yen and broke the 123.20 resistance.

- The EURJPY is currently facing a major resistance near 123.70-123.80 on the hourly chart.

- Today, the German Trade Balance was released by the Statistisches Bundesamt Deutschland.

- The result was a bit better than the last reading, as there was a trade surplus of €21.7B in Nov 2016.

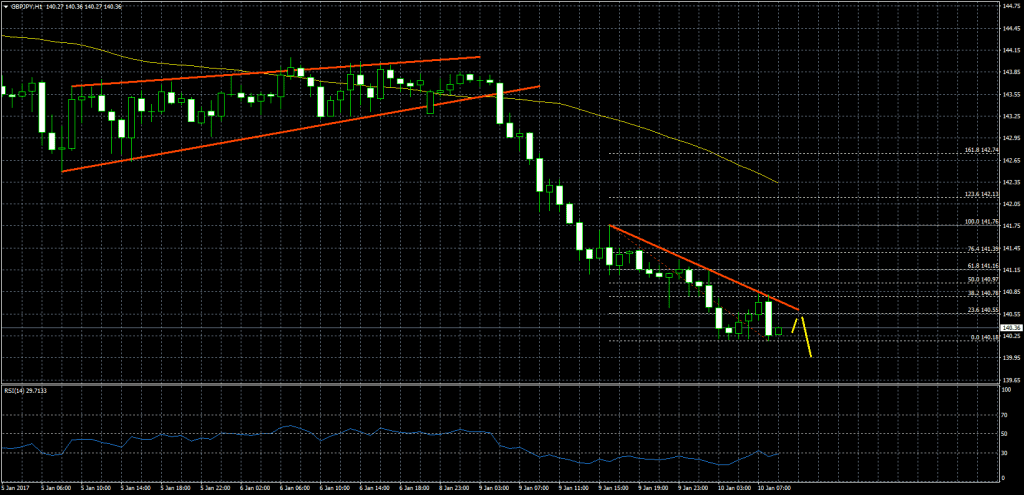

EURJPY Technical Analysis

The Euro managed to pop higher recently and moved past 123.20 against the Japanese yen to trade as high as 123.70. The EURJPY is currently facing a major resistance near 123.70-123.80 on the hourly chart, which can be considered as a pivot area.

A break above the highlighted resistance area may push the pair towards the 1.236 extension of the last wave from the 123.74 high to 122.01 low.

There are a couple of trend lines as well on the hourly chart, which may prove vital. Overall, a break above 12.80 is needed for further gains in EURJPY.

German Trade Balance

Today in the Euro Zone, the German Trade Balance figure was released by the Statistisches Bundesamt Deutschland. The market was aligned for a minor improvement in the balance between exports and imports of total goods and services in Nov 2016.

The result was a bit better than the last reading, as there was a trade surplus of €21.7B in Nov 2016. The report added that “German exports increased by 5.6% and imports by 4.5% in November 2016 year on year. After calendar and seasonal adjustment, exports increased by 3.9% and imports by 3.5% compared with October 2016”.

Overall, it looks like it won’t be easy for the Euro bulls to clear 123.80, but if they do, there can be a move towards 124.15.