Key Points

- The Euro popped higher against the Japanese Yen, and traded above the 116.40-50 resistance.

- There is a solid bullish trend line formed with support at 116.40 on the hourly chart of AUDJPY.

- Earlier today in the Euro Zone, the Italian Trade Balance figure for Feb 2017 was released by the National Institute of Statistics.

- The outcome was lower than the forecast, as there was a trade surplus of 1.880B, less than the forecast of 2.240B.

EURJPY Technical Analysis

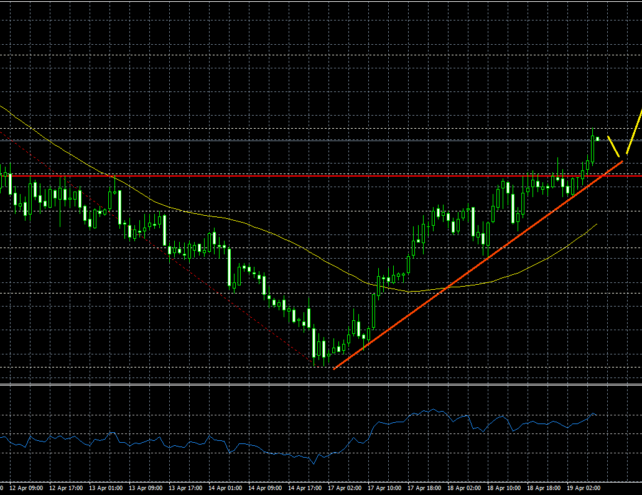

The Euro after trading as low as 114.84 against the Japanese Yen found support and traded higher. The upside move was strong, as the EURJPY pair was able to break the 38.2% Fib retracement level of the last decline from the 117.46 high to 114.84 low.

The pair was also able to clear the 116.40-50 resistance along with the 21 hourly simple moving average. However, the upside is currently facing resistance near the 76.4% Fib retracement level of the last decline from the 117.46 high to 114.84 low.

On the downside, there is a bullish trend line formed with support at 116.40 on the hourly chart, which can be seen as a buy zone.

Italian Trade Balance

Today in the Euro Zone, the Italian Trade Balance figure for Feb 2017 was released by the National Institute of Statistics. The forecast was lined up for the balance between exports and imports of total goods and services for Feb 2017 to post a surplus of 2.240B.

The result was lower than the forecast, as there was a trade surplus of 1.880B, less than the forecast of 2.240B. When we look at the Trade Balance to and from EU countries, then the trade surplus was 0.19B. It was lower when compared to the last revised reading of 0.32B.

Overall, the EURJPY has hardly any reason to decline, which is why it may continue to move higher, and could even break 117.00.