Key Points

- The Euro moved down this week against the British Pound and traded as low as 0.8605.

- The EURGBP pair is currently recovering, but likely to face sellers near 0.8640 and a broken support trend line on the hourly chart.

- Recently, the Euro Zone Consumer Confidence reading for March 2017 (preliminary) was released by the European Commission.

- The result was above the forecast, as there was a rise to 5 from the last reading of -6.2 in March 2017.

EURGBP Technical Analysis

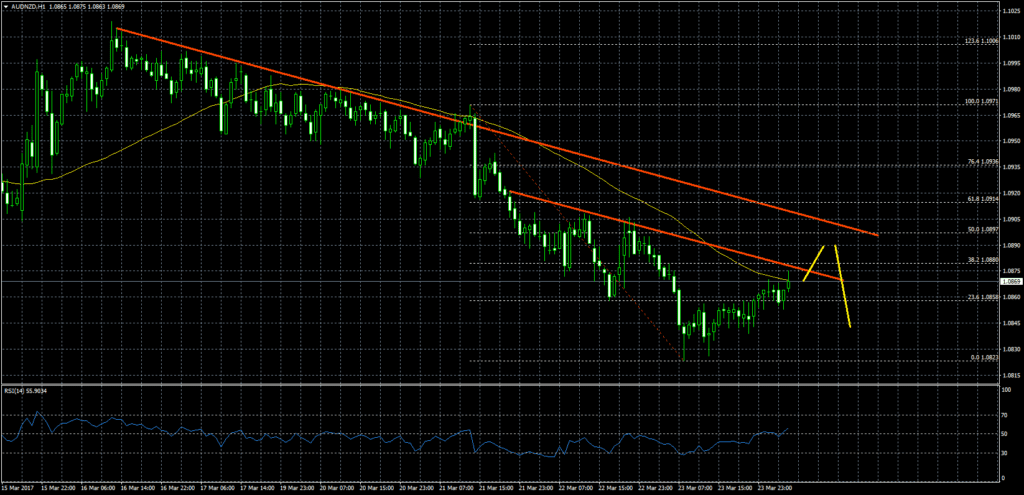

The Euro slowly moved down against the British Pound this week and traded below 0.8680 support. The EURGBP pair is currently moving higher, and trading near the 23.6% Fib retracement level of the last decline from the 0.8700 high to 0.8605 low.

However, the pair is likely to face barriers near 0.8640 and a broken support trend line on the hourly chart. The 21 hourly SMA and the 38.2% Fib retracement level of the last decline from the 0.8700 high to 0.8605 low is also around 0.8640 to act as a hurdle.

So, if the pair moves higher, one may consider selling near the 21 hourly SMA or 0.8640.

Euro Zone Consumer Confidence

The Euro Zone recently saw the release of the Consumer Confidence for March 2017 (preliminary) by the European Commission. The market was aligned for a rise from the last reading of -6.2 to -5.7 in March 2017 (preliminary).

The outcome was above the forecast, as there was a rise to 5 from the last reading of -6.2 in March 2017. Later today, the Euro Zone will witness the release of the Manufacturing Purchasing Managers Index (PMI) for March 2017 (preliminary) by the Markit Economics. The market is aligned for a decline from 55.4 to 55.3, and if there is a more than expected decline towards 55, there can be an increase in selling pressure in the short term.

Overall, the EURGBP might move higher, but most likely to face resistances near 0.8640 and 0.8650.