A MORE FREELY FLOATING (STRONGER) SWISS FRANC? SNB has previously defended 1.08 in EUR/CHF but seems to have lowered that boundary recently around 1.07. Still FX reserves continue to increase: growth is nearly CHF 200bn in the past two years which looks to be long-term unsustainable. Ultimately inflows will abate or the CHF will continue to appreciate. '

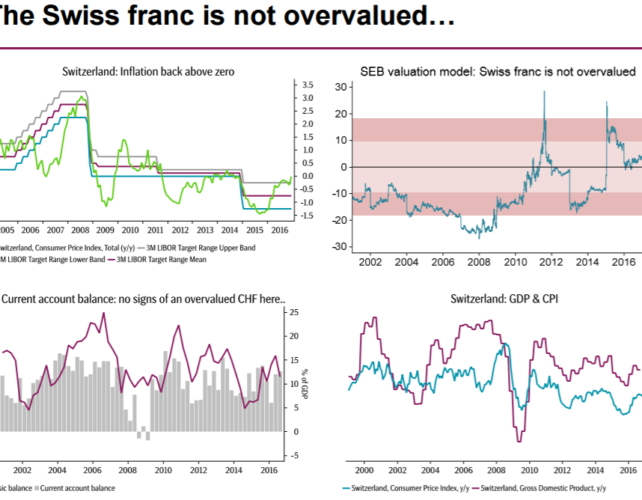

SHORT-TERM: Inflation is slowly rising, the Swiss National Bank expects CPI marginally above 0% 2017. The economy has done reasonably ok in the past year and the SNB projects the economy to grow by 1.5% 2017. Despite the talk of a suffering exporting industry, the current account surplus remains elevated.

SEB valuation model (SEBEER) also indicates that the trade-weighted currency is near the level we estimate to be long-term fair value. However SNB continues to state that the CHF is significantly overvalued. One crucial question remains: from where are the capital inflows emanating? Europe is recovering but economic and political risks remain high. 2017 holds a number of key European elections which could make investors run for safehaven again. Our base case is a slow grind lower in EUR/CHF as inflows continue and the cost outweighs the benefits of continued, big FX interventions. Could Switzerland introduce a tax on foreign capital inflows (low probability)?

LONG-TERM: We count on stronger for longer as the external sector seems to cope just fine with current CHF strength. EUR/CHF will likely test levels below 1.05 H1 2017. We think a broad range 1.04-1.08 will be established longer-term.

Copyright © 2017 SEB, eFXnews™Original Article