Key Points

- The Euro remains in an uptrend against the Canadian dollar with a close above 1.4150.

- There is a crucial bullish trend line support at 1.4150 formed on the hourly chart of the EURCAD pair.

- Today, the Euro Zone Sentix Investor Confidence was released by the Sentix GmbH for March 2017.

- The result was better than the forecast, as there was a rise to 20.7 from 17.4 in March 2017, compared with the forecast of 16.

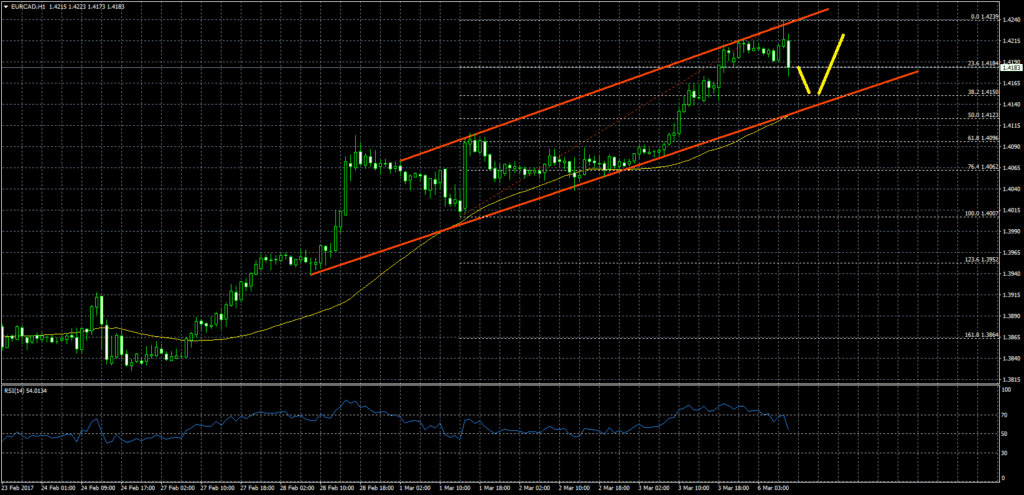

EURCAD Technical Analysis

The Euro climbed higher during the past few days against the Canadian dollar and broke the 1.40 and 1.41 resistance levels. The EURCAD pair recently traded as high as 1.4239 from where a correction wave started.

The pair is currently trading near the 23.6% Fib retracement level of the move from the 1.4007 low to 1.4239 high. However, the most important support is near 1.4150 and a crucial bullish trend line on the hourly chart.

The 21 hourly simple moving average and the 38.2% Fib retracement level of the move from the 1.4007 low to 1.4239 high are also near 1.4150 to provide support in the short term.

Euro Zone Sentix Investor Confidence

Today in the Euro Zone, the Sentix Investor Confidence for March 2017, which is a monthly survey which shows the market opinion about the current economic situation was released by the Sentix GmbH. The market was expecting a decline to 16 from 17.4.

The outcome was better than the forecast, as there was a rise to 20.7 from 17.4 in March 2017. The report added that the “sentix indicator that measures the risk of contagion jumps for the first time since 2012/13 above 45% which puts politics under pressure to curtail the crisis from spreading further. “.

The report was positive, which means the Euro remains supported, and any corrections from the current levels in EURCAD near 1.4150 might be considered as buying opportunity.