Key Points

- The Euro is in an uptrend above 1.5000 against the Aussie Dollar, and may continue to move higher.

- There is a crucial bullish trend line support forming near 1.5000 on the hourly chart of EURAUD.

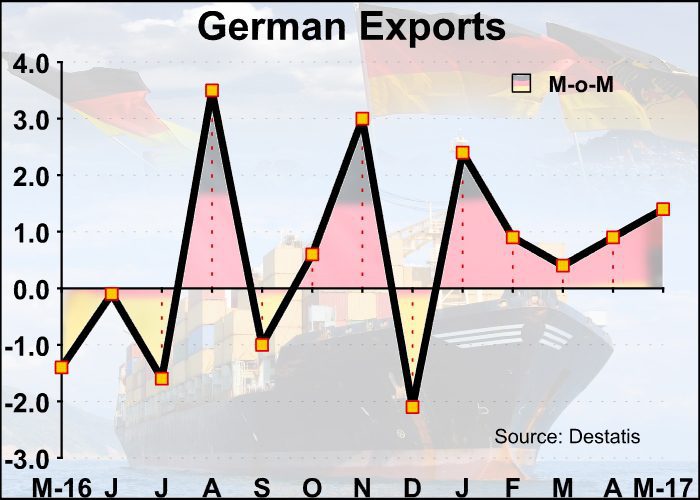

- Today in the Euro Zone, the German Trade Balance for May 2017 was released by the Statistisches Bundesamt Deutschland.

- The outcome was in line with the forecast, as the trade surplus was €20.3B, up from the last revised €19.7B.

EURAUD Technical Analysis

The Euro maintained a bit tone and traded above the 1.4980 and 1.5000 resistance levels against the Aussie Dollar. The EURAUD pair is currently trading higher and following a crucial bullish trend line support forming near 1.5000 on the hourly chart.

It recently climbed above the 38.2% Fib retracement level of the last decline from the 1.5075 high to 1.4963 low and currently attempting a close above the 21 hourly simple moving average.

The pair may dip a few pips, but could soon settle above the 50% Fib retracement level of the last decline from the 1.5075 high to 1.4963 low to gain pace above 1.5040 in the short term.

German Trade Balance

Today in the Euro Zone, the German Trade Balance for May 2017 was released by the Statistisches Bundesamt Deutschland. The market was positioned for a trade surplus of €20.3B, compared with the last €19.8B.

The actual result was in line with the forecast, as the trade surplus was €20.3B. On the other hand, the last reading was revised down from €19.8B to €19.7B. The report added that:

The foreign trade balance showed a surplus of 22.0 billion euros in May 2017. In May 2016, the surplus amounted to 20.7 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 20.3 billion euros in May 2017.

Overall, the EURAUD pair might continue to move higher and could easily retest the 1.5050 level in the near term.