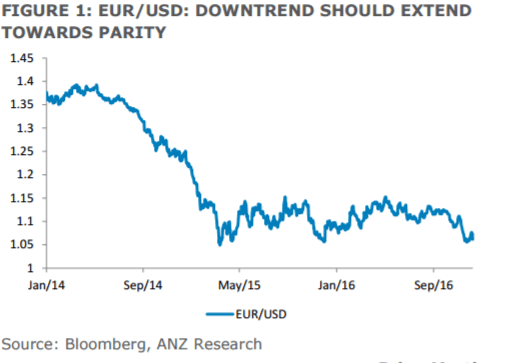

Euro has held tight since the setback from the Italian referendum and Renzi’s announced intention to step down. Despite an inital knee-jerk sell off to 1.05 levels it quickly regained the lead against the USD for most of the current week – so far. This morning as well the EURUSD is at 1.0778 as we await ECB rate decision later today.

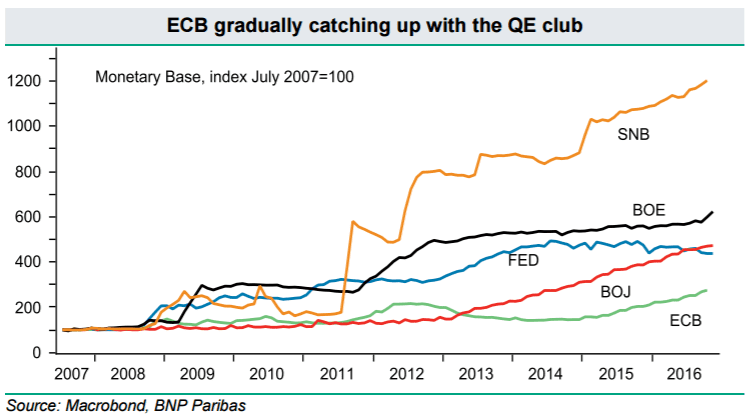

Markets are awaiting feedback on the ECB’s quantitative easing program as it is set to expire in the coming March. However upcoming elections across major european countries lile Germany and France will likely provide headwinds or concerns on the future stability of the EZ and the euro itself epsecially as we have just experienced the Italian PM’s step down. Analysts are pointing towards at least a 6-month extension – but we will have to see whether the ECB shall be reactive to any of this.

Overnight data showed that Japan’s Q3 final reading was lowerly revised to 0.3% from a previous 0.5%. Asian markets were mostly higher taking the cue from a positive US market close earlier as well. In europe optimism continued this morning ahead of the ECB.