Fundamental Forecast for Euro: Neutral

– The Euro’s technical posture improved after the ECB meeting, but the spot-on US NFPsproduced limited follow through.

– Still, June has proven to be a seasonally strong month for the Euro, at least in the QE era.

– Have a bullish (or bearish) bias on the Euro, but don’t know which pair to use? Use a Euro currency basket.

The European Central Bank, after weeks of rampant speculation, delivered on its promise made on May 8 for substantive policy action. Yet, the duration and depth of the impact on the Euro has proven thus very limited, raising the question: did the ECB do enough? The Euro ended the week down only against three of the major currencies, while posting meager gains against the other four. Evidently, the market is taking the ECB’s actions as a sign that they’re willing to do what is necessary to help spur lending and ultimately growth in the region; but not necessarily weaken the Euro.

The breadth of ECB action was plentiful, insofar as there were many changes to various aspects of the ECB’s current accommodative monetary program. Everything that was speculated upon in the weeks leading up to the June meeting ended up panning out. The notable changes, to wit:

– Rate cuts: The main refinancing rate was cut by -10-bps to 0.15%; the deposit facility rate was cut by -10-bps to -0.10%; and the marginal lending rate was cut by -35-bps to 0.40%. The rate cuts were in line with expectations, as negative rates had been discussed over the last few weeks (and priced in). The measures should help keep interbank lending rates (EONIA) below 0.40%.

– Liquidity: No more 1-month LTRO, but SMP holdings will no longer be sterilized after the June 10 auction; TLTRO (Targeted LTRO, the ECB’s version of the Bank of England’s Funding for Lending Scheme (FLS)) for up to four years. The SMP unsterilization will boost excess liquidity in the Euro-Zone by about €160B.

– Guidance: Reduced GDP forecast for 2014 from +1.2% to +1.0%, but upgraded 2015 forecast from +1.5% to +1.7%; 2016 GDP forecast unchanged at +1.8%; 2014 inflation forecast downgraded from +1.0% to +0.7%; 2015 inflation forecast downgraded from +1.3% to +1.1%; 2016 inflation forecast downgraded from +1.5% to +1.4%; Asset-Backed Securities (ABS) purchase program discussed.

The efforts made by the ECB are established across all fronts, from traditional easing steps to non-standard measures. There were two definitive steps taken, however, that can be pointed to as perhaps viable reasons why the Euro didn’t endure a greater decline around the ECB’s meeting on Thursday. First, the ECB’s updated its expected EURUSD exchange rate over its forecast horizon to $1.3800 from $1.3600. Second, President Mario Draghi said in his Q&A that the ECB’s rates were essentially ‘at the lower bound’.

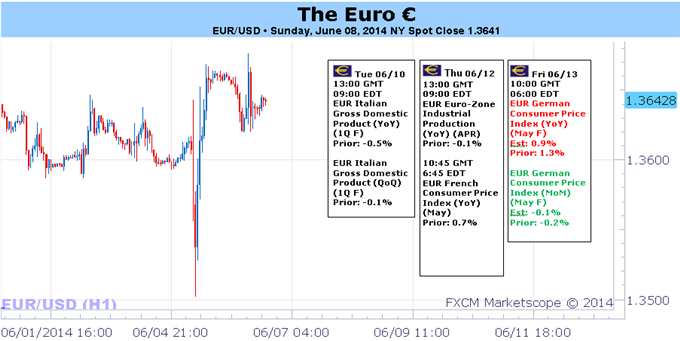

What these slight tweaks to the ECB’s policies equate to is that, at current time, there is no real imperative to speculate that the ECB could cut rates further. Additionally, it means that the EURUSD (at $1.3641 at the end of the week) is below the ECB’s expected exchange rate. Going forward, the market will pay less attention to the ECB – that is unless economic data weakens to the point that further action may be necessary. Visit the DailyFX Economic Calendar to see what data will be in the Euro driver seat this week. –CV

To receive reports from this analyst, sign up for Christopher’s distribution list.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.Learn forex trading with a free practice account and trading charts from FXCM.

Source: Daily fx