Eurozone policymakers cannot be sanguine about the economic outlook despite the moderate recovery due to the persistence of geopolitical risks, profitability erosion of banks, weak inflation dynamics and the high reliance on monetary policy stimulus, European Central Bank President Mario Draghi said Friday.

"Even if there are many encouraging trends in the euro area economy, the recovery remains highly reliant on a constellation of financing conditions that, in turn, depend on continued monetary support," Draghi said in a speech at the European Banking Congress in Frankfurt. "We cannot yet drop our guard."

"The ECB will continue to act, as warranted, by using all the instruments available within our mandate to secure a sustained convergence of inflation towards a level below, but close to 2 percent."

The ECB Chief also pointed out that there was still "significant degree of uncertainty" regarding the economic and inflation outlooks.

Defending low interest rates, Draghi said banking system inefficiencies caused by structural and legacy challenges could have been exposed by the low interest rate environment.

"But they have certainly not been created by it," he added.

Regarding the price stability outlook, Draghi said the persisting output gap continue to keep inflation dynamics weak. "We do not yet see a consistent strengthening of underlying price dynamics," he said.

In future, the ECB's assessment will depend on whether there is a sustained adjustment in the path of inflation towards the aim of 'below, but close to 2 percent', the ECB President said.

"And that means that inflation convergence towards 2 percent is durable, even with a reduction in monetary accommodation. Inflation dynamics, in other words, need to be self-sustained," Draghi added.

"Monetary policy remains a key ingredient in the reflation scenario we foresee for the euro area in the coming years."

Inflation accelerated to a near two-year high of 0.5 percent in October, yet far from ECB's target.

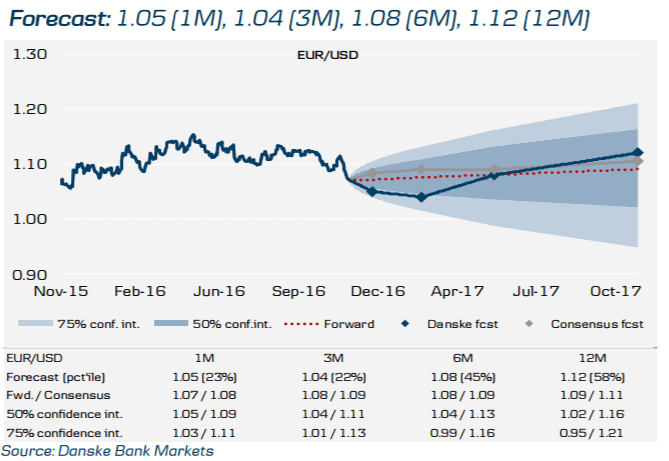

Though the ECB is widely expected to extend its monthly asset purchases of EUR 80 billion beyond March 2017, the result of the U.S. election and the consequent surge in bond yields have complicated the outlook.

The next ECB rate-setting session is scheduled for December 8.

Speaking at the same event, ECB Governing Council member and Bundesbank Chief Jen Weidmann said unconventional measures must be used with extra care, even if they are temporary.

Monetary policy need not respond automatically whenever inflation deviates from levels consistent with the definition of price stability, he added.

ECB Executive Board member Yves Mersch said on Thursday that stimulus measures are not free from side-effects in the long run and must be withdrawn as soon as possible, though it may take some time due to the huge volume of asset purchases. The policymaker also cautioned against excessive expectations over the December policy meeting.

On banking reform, Draghi said now was the time to finalize the regulatory agenda and enter a period of stability, and the focus should be on implementation, not on new design.

"Regulatory measures should be implemented in a balanced way that ensures a level playing-field globally," he said. "And while marginal adjustments are possible, there should be no rolling back on what has been decided."

by RTT Staff Writer

For comments and feedback: editorial@rttnews.com

Economic News

What parts of the world are seeing the best (and worst) economic performances lately? Click here to check out our Econ Scorecard and find out! See up-to-the-moment rankings for the best and worst performers in GDP, unemployment rate, inflation and much more.